RELATED STORIES

RELATED STORIES

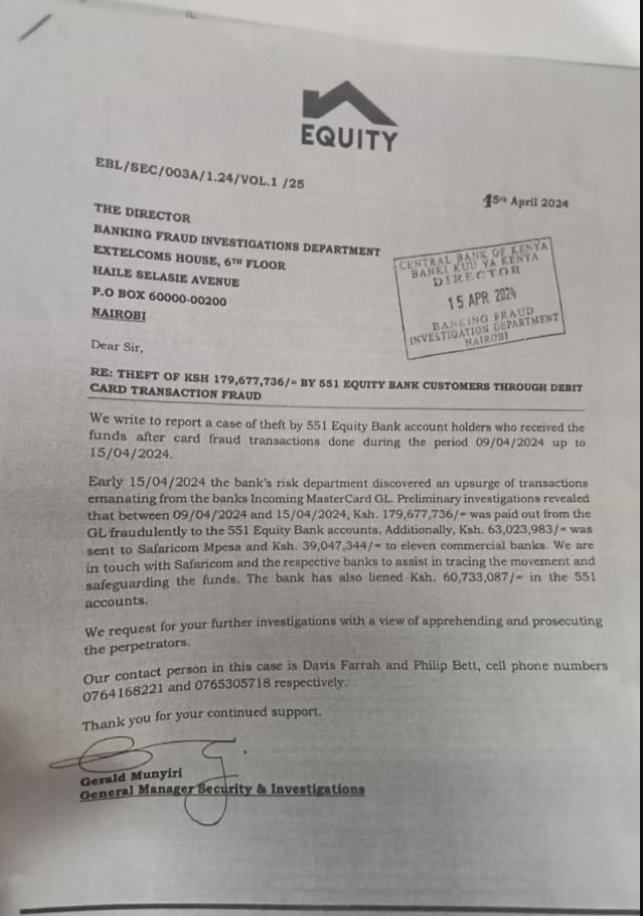

In a shocking turn of events, hackers have managed to steal a staggering Ksh 179 million from Equity Bank accounts in a massive card fraud scandal. The news broke when a leaked letter addressed to the Director of the Banking Fraud Investigations Department at Equity Bank surfaced online, shedding light on the extent of the breach.

The letter, which was obtained by a source inside Equity Bank and shared by prominent blogger Cyprian, Is Nyakundi, detailed the alarming breach that has left customers reeling. The bank is now in damage control mode as they work to contain the fallout from this unprecedented cyberattack.

The scale of the theft is truly staggering, with millions of shillings siphoned off from unsuspecting customers’ accounts. This breach has not only exposed the vulnerabilities in Equity Bank’s security systems but has also raised concerns about the safety of online banking in general.

Equity Bank has assured customers that they are working closely with law enforcement agencies to track down the perpetrators and recover the stolen funds. However, the damage has already been done, and customers are left feeling vulnerable and exposed.

This incident serves as a stark reminder of the importance of cybersecurity in today’s digital age. With cyberattacks becoming increasingly sophisticated, it is more crucial than ever for banks and financial institutions to invest in robust security measures to protect their customers’ sensitive information.

As news of this massive breach spreads, customers are left wondering if their own accounts are at risk. Many are now questioning the safety of online banking and are considering taking additional precautions to safeguard their financial assets.

In response to the breach, Equity Bank has issued a statement urging customers to remain vigilant and report any suspicious activity on their accounts. They have also promised to enhance their security protocols to prevent similar incidents from occurring in the future.

The fallout from this breach is likely to have far-reaching implications for Equity Bank and the banking industry as a whole. Customers are now demanding greater transparency and accountability from financial institutions when it comes to protecting their personal information.

As the investigation into this cyberattack continues, customers are left with a sense of unease and uncertainty. Many are now considering switching to alternative banking options that offer greater security and peace of mind.

In conclusion, the news of hackers stealing Ksh 179 million from Equity Bank accounts in a massive card fraud scandal is a stark reminder of the risks associated with online banking. As customers grapple with the fallout from this breach, it is crucial for banks to prioritize cybersecurity and take proactive measures to protect their customers’ sensitive information. Only by investing in robust security measures can financial institutions hope to regain the trust and confidence of their customers in an increasingly digital world..

Hackers Swipe Ksh 179 Million From Equity Bank Accounts In Massive Card Fraud Scandal

We got our hands on some interesting scoop — a letter leaked to us by a source inside Equity Bank.

This letter was addressed to the Director of the Banking Fraud Investigations Department at… pic.twitter.com/SnJ7nJFUCC

— Cyprian, Is Nyakundi (@C_NyaKundiH) April 16, 2024

Source

C_NyaKundiH said Hackers Swipe Ksh 179 Million From Equity Bank Accounts In Massive Card Fraud Scandal

We got our hands on some interesting scoop — a letter leaked to us by a source inside Equity Bank.

This letter was addressed to the Director of the Banking Fraud Investigations Department at…

RELATED STORY.