RELATED STORIES

RELATED STORIES

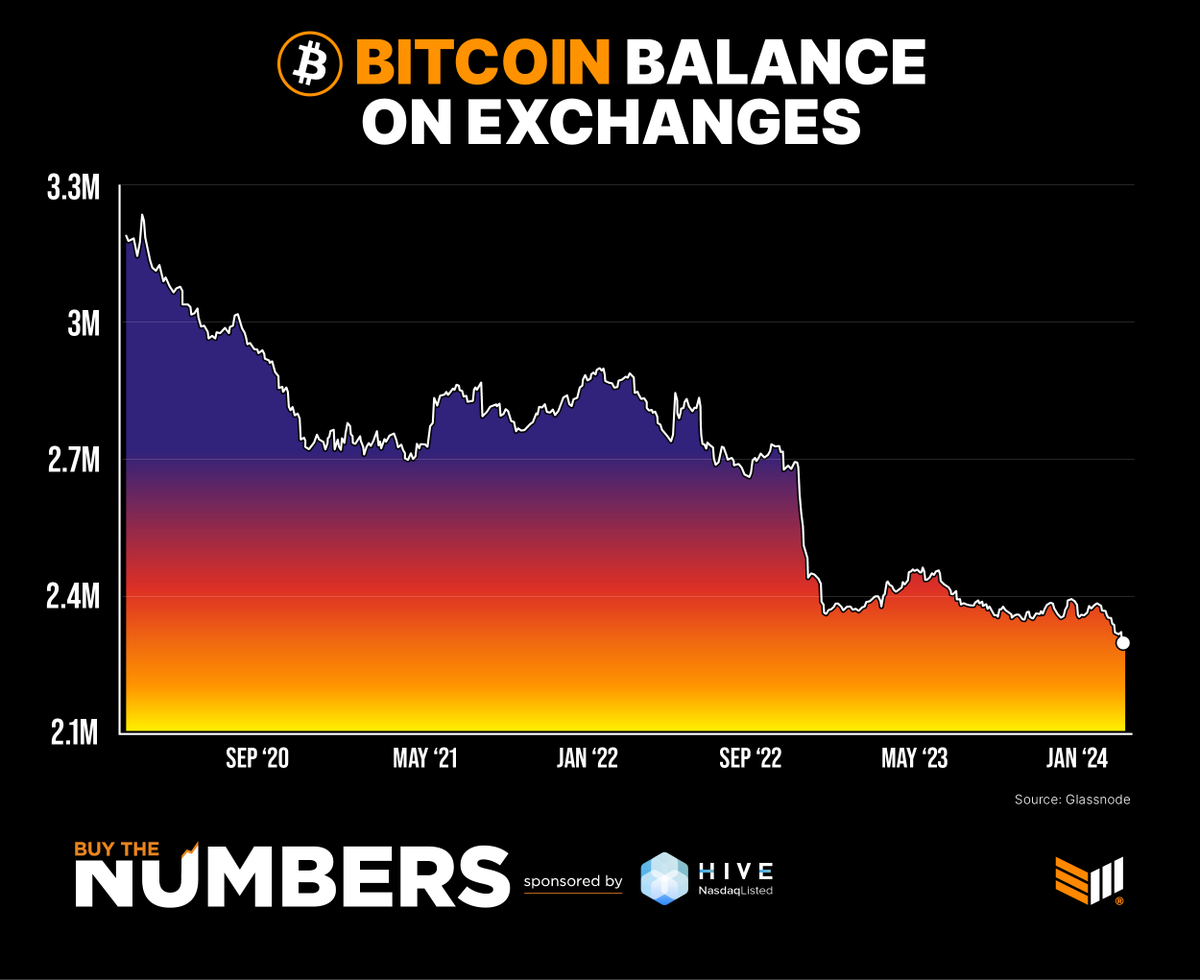

In a recent development in the world of cryptocurrency, Bitcoin is being taken off exchanges in record numbers ahead of the highly anticipated halving event next month. This news has sparked excitement among investors and enthusiasts alike, with many viewing this trend as a bullish indicator for the future of Bitcoin.

The halving event, which is set to occur in May 2024, is a significant moment in the Bitcoin network’s history. It involves a reduction in the rate at which new Bitcoins are created, cutting the rewards for miners in half. This event occurs approximately every four years and is designed to control inflation and ensure the scarcity of Bitcoin. As a result, many investors see the halving as a catalyst for a potential price increase in the cryptocurrency.

The recent surge in Bitcoin being taken off exchanges suggests that investors are preparing for the halving event by holding onto their Bitcoin rather than trading it. This trend indicates a growing confidence in the long-term value of Bitcoin and a belief that its price will rise following the halving. By taking their Bitcoin off exchanges, investors are effectively reducing the supply of Bitcoin available for trading, which could drive up the price due to increased demand.

This news comes at a time when Bitcoin’s price has been steadily climbing, with the cryptocurrency hitting new all-time highs in recent months. The combination of a bullish market sentiment and the upcoming halving event has created a perfect storm of optimism among Bitcoin investors.

The decision to take Bitcoin off exchanges is not a new phenomenon, but the current levels of Bitcoin being withdrawn are unprecedented. This trend suggests that investors are increasingly viewing Bitcoin as a long-term investment rather than a short-term trading opportunity. By holding onto their Bitcoin, investors are betting on the cryptocurrency’s future growth potential and are willing to weather any short-term price fluctuations in exchange for potential long-term gains.

The impact of Bitcoin being taken off exchanges is already being felt in the market, with some analysts predicting that this trend could lead to a supply shortage of Bitcoin on exchanges. This scarcity could drive up the price of Bitcoin even further, as investors scramble to acquire the cryptocurrency in anticipation of future price gains.

Overall, the news of Bitcoin being taken off exchanges in record numbers ahead of the halving event is a positive sign for the cryptocurrency market. It reflects growing confidence in Bitcoin’s long-term value and potential for future growth. As the halving event approaches, investors are positioning themselves for potential price increases by holding onto their Bitcoin. This trend could signal a new phase of growth for Bitcoin and further solidify its position as a leading digital asset in the financial world.

In conclusion, the recent surge in Bitcoin being taken off exchanges is a bullish indicator for the cryptocurrency market. Investors are increasingly viewing Bitcoin as a long-term investment and are preparing for potential price increases following the halving event. This trend could lead to a supply shortage of Bitcoin on exchanges and drive up the price of the cryptocurrency even further. As the halving event draws near, the future looks bright for Bitcoin and its investors..

JUST IN: #Bitcoin is being taken off exchanges in record numbers ahead of the halving next month

Bullish pic.twitter.com/e4V9YkTNiO

— Bitcoin Magazine (@BitcoinMagazine) March 8, 2024

Source

BitcoinMagazine said JUST IN: #Bitcoin is being taken off exchanges in record numbers ahead of the halving next month

Bullish

RELATED STORY.