RELATED STORIES

RELATED STORIES

In a major development for the cryptocurrency market, BlackRock, the world’s largest asset manager, has filed with the U.S. Securities and Exchange Commission (SEC) to purchase spot Bitcoin exchange-traded funds (ETFs) for its Global Allocation Fund. This move by BlackRock signals a significant endorsement of Bitcoin as an asset class and could potentially pave the way for more institutional investment in the cryptocurrency space.

The filing by BlackRock comes at a time when Bitcoin has been gaining mainstream acceptance and adoption. The cryptocurrency has seen a surge in value over the past year, reaching new all-time highs and attracting a growing number of retail and institutional investors. With BlackRock’s entry into the Bitcoin ETF market, the cryptocurrency could see even greater interest from traditional investors looking to diversify their portfolios.

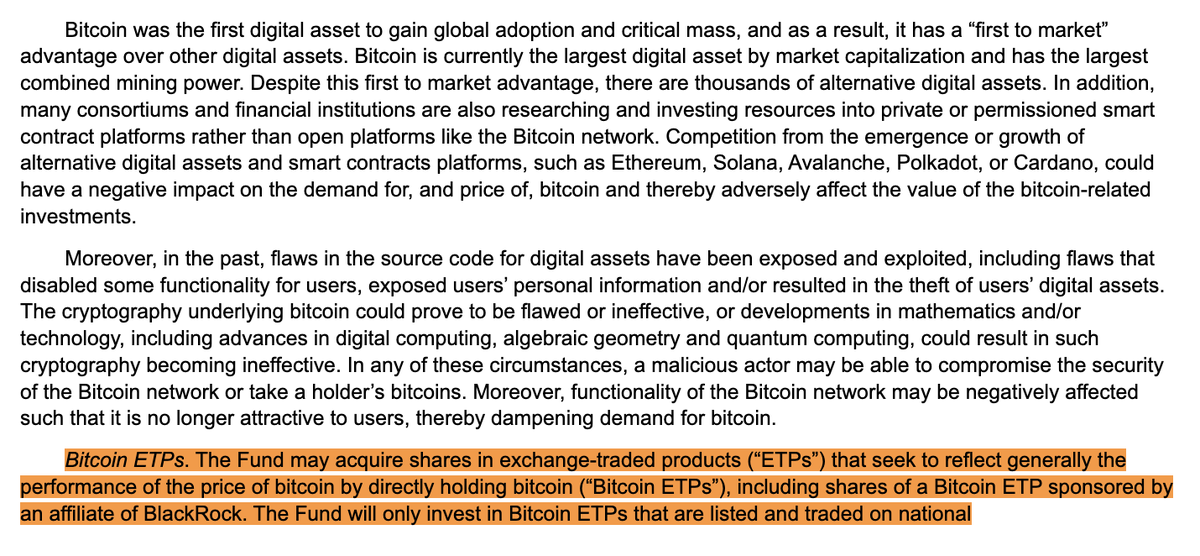

The decision by BlackRock to invest in Bitcoin ETFs is a clear indication of the growing acceptance of cryptocurrencies as legitimate investment assets. ETFs are a popular investment vehicle for many investors, offering a convenient way to gain exposure to a wide range of assets without having to directly hold them. By purchasing Bitcoin ETFs, BlackRock’s Global Allocation Fund will be able to benefit from the potential growth and value appreciation of the cryptocurrency, without the need to directly hold and manage Bitcoin.

This move by BlackRock is likely to have a ripple effect across the investment landscape, as other asset managers and institutional investors may now feel more confident in adding Bitcoin to their investment portfolios. The increased institutional interest in Bitcoin could lead to greater liquidity and stability in the cryptocurrency market, making it a more attractive option for investors looking to diversify their holdings.

The news of BlackRock’s filing with the SEC has already caused a stir in the cryptocurrency community, with many enthusiasts and investors expressing excitement and optimism about the potential implications of this development. The price of Bitcoin has seen a slight increase following the announcement, as investors anticipate the positive impact that BlackRock’s entry into the Bitcoin ETF market could have on the cryptocurrency’s value.

In addition to BlackRock’s filing with the SEC, other major financial institutions have also been showing interest in Bitcoin and other cryptocurrencies. Companies like Tesla, Square, and MicroStrategy have all made significant investments in Bitcoin in recent years, further solidifying the cryptocurrency’s status as a legitimate and valuable asset.

The decision by BlackRock to purchase Bitcoin ETFs for its Global Allocation Fund is a significant milestone for the cryptocurrency market and could potentially open the door to even greater institutional investment in Bitcoin and other cryptocurrencies. As more traditional financial institutions and asset managers begin to recognize the value and potential of cryptocurrencies, we could see a continued rise in the adoption and acceptance of digital assets in the mainstream investment landscape.

Overall, BlackRock’s move to invest in Bitcoin ETFs is a positive development for the cryptocurrency market and could signal a new era of institutional acceptance and adoption of digital assets. With the backing of a major player like BlackRock, Bitcoin and other cryptocurrencies are poised to become an increasingly important part of the global investment landscape..

JUST IN: BlackRock filed with the SEC to purchase spot #Bitcoin ETFs for its Global Allocation Fund. pic.twitter.com/qYfQoQ3Cbr

— Bitcoin Magazine (@BitcoinMagazine) March 7, 2024

Source

BitcoinMagazine said JUST IN: BlackRock filed with the SEC to purchase spot #Bitcoin ETFs for its Global Allocation Fund.

RELATED STORY.