Trump Bans CBDC: A Major Win for Freedom Against Big Banks’ Control!

.

President Trump has signed an executive order banning Central Bank Digital Currency (CBDC) This was going to be abused by big banks as a social credit score where they could freeze your money for wrong think Huge day for freedom https://t.co/QSyLZec5u7

—————–

President Trump’s Executive Order Against Central Bank Digital Currency (CBDC)

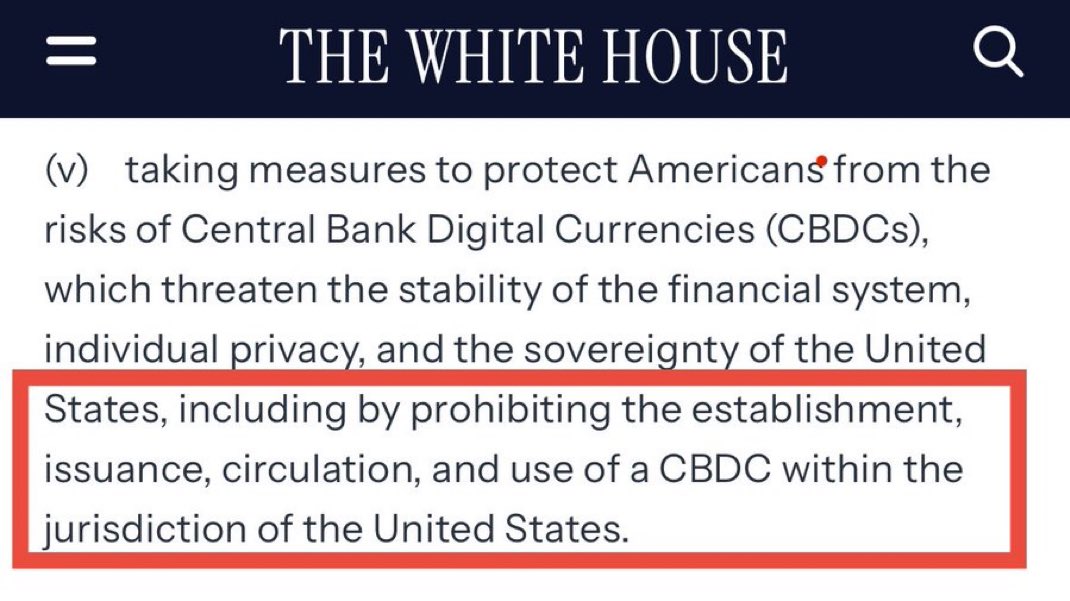

In a significant move for financial freedom, President Trump has recently signed an executive order that bans the implementation of Central Bank Digital Currency (CBDC) in the United States. This decision has sparked considerable conversation and debate, especially regarding the implications of CBDCs for individual liberties and the banking system.

Central Bank Digital Currency represents a digital form of a country’s fiat currency, issued and regulated by the central bank. While proponents argue that CBDCs could streamline transactions and enhance financial inclusion, critics raise pressing concerns about privacy, control, and potential misuse. The executive order signed by Trump reflects these concerns, particularly the fear that a CBDC could be exploited by large financial institutions as a tool for social control.

One of the most alarming aspects highlighted by critics is the potential for CBDCs to facilitate a social credit system. Such a system could enable banks and governments to monitor and evaluate individuals’ financial behaviors, granting them the power to restrict access to funds based on perceived "wrongthink." This scenario raises significant questions about personal freedom and the right to make independent financial choices without government interference.

The timing of Trump’s executive order is crucial, as discussions around CBDCs have intensified globally. Various countries are exploring or have already initiated the development of their own digital currencies. For instance, China has made headlines with its digital yuan, which has raised concerns about surveillance and control over citizens’ financial transactions. Trump’s action can be seen as a proactive stance to safeguard American citizens from similar risks, ensuring that financial privacy and autonomy are preserved.

Supporters of the ban view this executive order as a monumental step toward protecting freedom in the financial sector. They argue that the introduction of a CBDC could lead to an erosion of consumer rights and increased government oversight, which is contrary to the principles of a free market. By prohibiting CBDCs, Trump aims to maintain a financial system that respects individual freedoms and promotes a competitive banking environment.

Moreover, the ban on CBDCs aligns with Trump’s broader agenda of reducing regulatory burdens and promoting economic growth. By preventing potential overreach by financial institutions and government entities, this executive order could foster a more innovative and resilient economic landscape.

The reaction on social media has been largely supportive, with many users praising the decision as a victory for personal liberties. The ban has been framed as a crucial step in the ongoing battle against overreach by banks and the government, reinforcing the idea that financial systems should empower individuals rather than control them.

In conclusion, President Trump’s signing of the executive order banning Central Bank Digital Currency is a pivotal moment in the ongoing discourse surrounding the future of money and personal freedom. By taking a firm stance against CBDCs, Trump is advocating for the protection of individual rights in the financial realm, ensuring that Americans retain control over their own money without the threat of undue influence from banks or governmental authorities. The implications of this decision will likely resonate for years to come as the dialogue surrounding digital currencies continues to evolve.

President Trump has signed an executive order banning Central Bank Digital Currency (CBDC)

This was going to be abused by big banks as a social credit score where they could freeze your money for wrong think

Huge day for freedom pic.twitter.com/QSyLZec5u7

— DC_Draino (@DC_Draino) January 23, 2025

President Trump has signed an executive order banning Central Bank Digital Currency (CBDC

On January 23, 2025, a significant shift occurred in the financial landscape when President Trump signed an executive order that effectively bans Central Bank Digital Currency (CBDC). This decision has stirred considerable debate among economists, political analysts, and everyday citizens alike. Many are celebrating this move as a win for financial freedom, while others express concern over the implications it may have on the future of money and banking in the United States.

So, what exactly does this executive order entail? In simple terms, it prevents the establishment of a digital currency that would be managed by the central bank. This is a big deal because CBDCs could potentially allow governments to monitor and control financial transactions more closely than ever before. Some critics argue that this could lead to a situation where financial institutions misuse this power, creating a social credit score system reminiscent of those in some authoritarian regimes.

This was going to be abused by big banks as a social credit score where they could freeze your money for wrong think

As the discussion around this executive order unfolds, one of the most alarming aspects people are highlighting is the potential for abuse by large banks. The fear is that a CBDC could be manipulated to enforce a social credit score system. This means that banks could have the power to freeze individuals’ money for what they deem “wrong think” or actions that don’t align with certain ideological or political standards.

Imagine waking up one day to find your bank account frozen because you posted something on social media that was deemed inappropriate or controversial. That’s the nightmare scenario many advocates against CBDC are warning about. The idea that your financial freedom could be compromised by an institution’s subjective judgment is unsettling, to say the least. Critics argue that this kind of control over personal finances is not just an invasion of privacy but a threat to individual liberty itself.

Those in favor of the executive order argue that banning CBDCs is a protective measure against such potential abuses. It’s a stand for personal autonomy and a pushback against an increasingly digitized and surveilled society. By removing the possibility of a government-controlled digital currency, individuals retain more control over their financial lives.

Huge day for freedom

For many, January 23, 2025, marks a huge day for freedom. Activists, libertarians, and everyday citizens who value personal rights and freedoms are celebrating. They view this executive order as a safeguard against overreach by banks and the government. The potential for CBDCs to be weaponized against citizens has sparked a renewed interest in traditional forms of currency and decentralized financial systems like cryptocurrencies.

People are beginning to realize the importance of understanding money in a digital age. With the rise of digital currencies, including Bitcoin and Ethereum, there’s a growing movement advocating for financial literacy. Understanding how these currencies work and their implications can empower individuals to make informed decisions about their finances.

There’s also a growing conversation about the importance of maintaining cash as a valid form of payment. As digital transactions become more prevalent, the risk of a cashless society looms. This could further entrench the power of banks and governments over personal finances. The executive order banning CBDCs may serve as a wake-up call, encouraging people to think critically about how they engage with money and what systems they want to support.

As we reflect on this monumental day, it’s clear that the implications of banning Central Bank Digital Currency extend far beyond the financial world. It taps into broader themes of freedom, privacy, and the ongoing struggle to maintain individual rights in an age of technology.

In conclusion, the decision to ban CBDCs raises essential questions about the future of money and individual rights. It highlights the need for ongoing dialogue about how we navigate the intersection of technology, finance, and freedom.

For those interested in exploring this topic further, you can read about the implications of CBDCs on platforms like [CoinDesk](https://www.coindesk.com) and [Forbes](https://www.forbes.com). Understanding these developments is crucial for anyone who wants to stay informed about the future of currency and financial freedom.