BREAKING: 50X Hyperliquid Whale Enters $47M ETH Long Position—What Do They Know?

.

BREAKING:

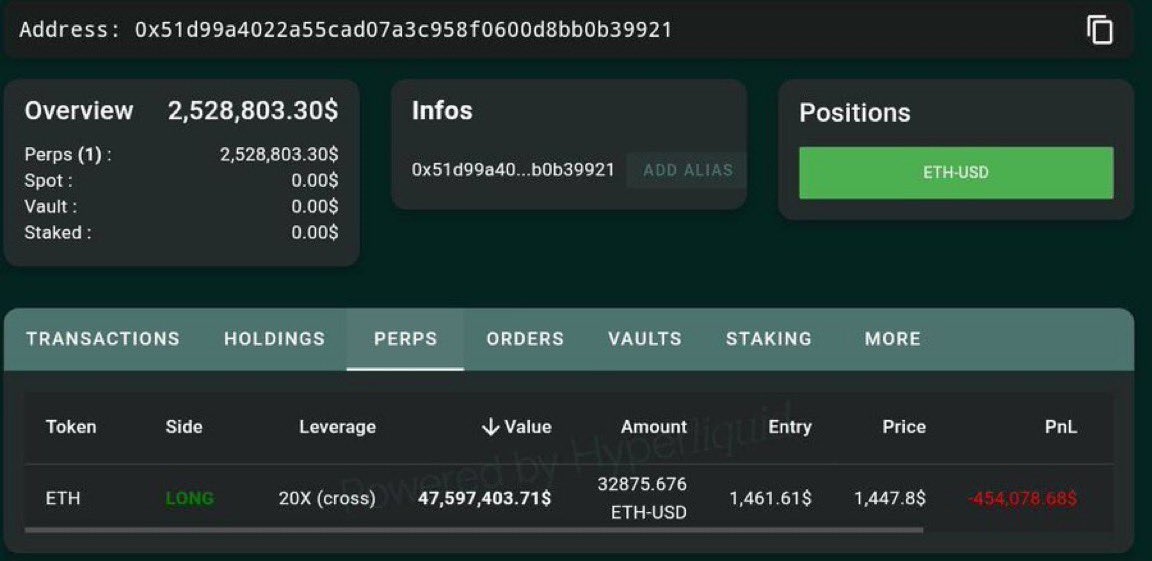

THE 50X HYPERLIQUID WHALE IS BACK AND JUST ENTERED A $47 MILLION $ETH LONG POSITION WITH 20X LEVERAGE.

HE 100% KNOWS SOMETHING.

—————–

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. : Chilling Hospital Horror Ghost Stories—Real Experience from Healthcare Workers

The Return of the 50x Hyperliquid Whale: A Major $ETH Long Position

In a dramatic development that has caught the attention of cryptocurrency enthusiasts and investors alike, the notorious 50x Hyperliquid Whale has re-emerged in the crypto market. This whale, known for making significant trades with substantial leverage, has just entered a long position worth an impressive $47 million in Ether (ETH) using 20x leverage. This bold move has raised eyebrows, prompting speculation about what insights or information this whale might possess.

Understanding the Whale Phenomenon in Cryptocurrency

The term "whale" refers to individuals or entities that hold large amounts of cryptocurrency. These players have the power to influence market trends and prices due to their ability to execute large trades. Whales often employ high leverage to maximize their potential profits, but this strategy also comes with increased risk.

The 50x Hyperliquid Whale has become a prominent figure in the crypto community, particularly due to its history of making significant market moves. Traders and investors closely monitor its activities as they can serve as indicators of market sentiment and potential price shifts.

The Implications of the $47 Million Long Position

The recent entry of the 50x Hyperliquid Whale into a $47 million long position in ETH is particularly noteworthy for several reasons:

- Market Impact: Large trades like this can dramatically affect the price of Ethereum. As the whale’s position becomes known, other traders may follow suit, leading to increased buying pressure. This can result in a bullish trend for ETH, at least in the short term.

- Leverage and Risk: The use of 20x leverage indicates a high level of confidence from the whale regarding the future price of ETH. However, employing such leverage is risky. If the market moves against the position, the whale could face substantial losses. This scenario highlights the delicate balance between risk and reward in cryptocurrency trading.

- Market Sentiment and Information: The tweet suggesting that the whale "100% knows something" speaks to the speculation around the reasons behind this large investment. Whales often have access to information or insights that the average investor does not. This could include knowledge of upcoming market developments, regulatory changes, or technological advancements within the Ethereum ecosystem.

The Role of Ethereum in the Crypto Market

Ethereum has solidified its position as a leading cryptocurrency, known for its smart contract functionality and decentralized applications (dApps). The network has seen significant growth and adoption, with various projects built on its blockchain. As Ethereum evolves, so does its potential for price appreciation, making it an attractive asset for both retail and institutional investors.

Analyzing the $ETH Long Position

The decision by the 50x Hyperliquid Whale to enter a long position in ETH raises questions about the current market conditions. Some factors that could be influencing this decision include:

- Market Trends: Analyzing recent market trends can provide insights into why the whale chose this moment to invest. If Ethereum has been on an upward trajectory or if there are positive developments within the Ethereum ecosystem, these could contribute to the whale’s optimism.

- Technical Analysis: Traders often rely on technical indicators to make informed decisions. The whale may have identified key support levels or bullish signals that suggest a potential price increase for ETH.

- Market News: The cryptocurrency market is sensitive to news and events. Developments such as partnerships, upgrades to the Ethereum network (like Ethereum 2.0), or regulatory news can significantly impact the price of ETH. Whales often react quickly to such news, making strategic moves based on their interpretations.

The Broader Market Context

The entry of the 50x Hyperliquid Whale into a substantial long position comes at a time when the overall cryptocurrency market is experiencing volatility. Various factors, including macroeconomic conditions, regulatory developments, and technological innovations, contribute to the fluctuations in cryptocurrency prices.

Investors should remain vigilant and consider the broader market context when interpreting the whale’s actions. While this move may signal optimism for Ethereum, it is essential to conduct thorough research and analysis before making investment decisions.

Conclusion: What Lies Ahead for Ethereum?

The return of the 50x Hyperliquid Whale and its significant long position in Ethereum has sent ripples through the cryptocurrency community. This bold move raises questions about market sentiment, potential price movements, and the factors influencing the whale’s decision.

As Ethereum continues to evolve and adapt to the changing landscape of the cryptocurrency market, investors should pay close attention to major players like the Hyperliquid Whale. Understanding the motivations and strategies of these influential figures can provide valuable insights for navigating the complex world of cryptocurrency trading.

In summary, the recent developments surrounding the 50x Hyperliquid Whale’s $47 million long position in ETH exemplify the intricate dynamics at play in the cryptocurrency market. As investors analyze the implications of this move, it serves as a reminder of the importance of staying informed and adapting to the ever-changing landscape of digital assets. Whether this position leads to significant price increases for Ethereum or serves as a cautionary tale about the risks of high leverage remains to be seen. Investors should proceed with caution and conduct their own analysis as they navigate the volatile world of cryptocurrency.

BREAKING:

THE 50X HYPERLIQUID WHALE IS BACK AND JUST ENTERED A $47 MILLION $ETH LONG POSITION WITH 20X LEVERAGE.

HE 100% KNOWS SOMETHING. pic.twitter.com/KuZKYjWsOo

— Crypto Rover (@rovercrc) April 7, 2025

BREAKING:

The world of cryptocurrency is always buzzing with excitement, and today is no exception! The infamous “50X Hyperliquid Whale” has made headlines by entering a massive long position in Ethereum. This whale just dropped a staggering $47 million with 20X leverage, and let me tell you, that’s not something you see every day in the crypto space. If you’re wondering what this means for the market and why this whale is making such a bold move, you’re in the right place!

THE 50X HYPERLIQUID WHALE IS BACK AND JUST ENTERED A $47 MILLION $ETH LONG POSITION WITH 20X LEVERAGE.

First off, let’s break down what it means to have a 50X hyperliquid position. This term refers to a trader who uses high leverage to maximize their potential returns. In simpler terms, it means they are betting big on the price of Ethereum going up. A $47 million investment is no small feat, and using 20X leverage means this whale is confident that Ethereum is on the verge of a significant price increase.

So why would someone take such a risk? Well, it’s all about the potential rewards. When you leverage your investments, you can amplify your gains, but it also comes with the risk of amplifying your losses. This whale clearly believes they have insight into market conditions that the average trader might not. Some speculate that they might have access to insider information or just a keen sense of market trends.

HE 100% KNOWS SOMETHING.

This phrase resonates deeply within the trading community. When a trader with a track record of success makes a move like this, it sends shockwaves through the market. Many traders and investors alike start speculating about what this whale knows. Are there upcoming developments in Ethereum? Is there news that could potentially drive the price up? The community’s curiosity is piqued, and it’s a reminder of how interconnected information and trading can be in the crypto world.

Whales like this one often influence market psychology. When they make significant trades, it can lead to a ripple effect, prompting other investors to follow suit. It’s like a game of follow the leader, where the confidence of one player can sway the decisions of many. This is why keeping an eye on whale activity is crucial for anyone involved in cryptocurrency trading.

WHAT DOES THIS MEAN FOR ETHEREUM?

For Ethereum specifically, this move could signal a bullish trend. The cryptocurrency market is notoriously volatile, and significant investments can lead to price surges. If this whale’s bet pays off, it could bolster other investors’ confidence, leading to a broader upward momentum in Ethereum’s price.

Moreover, Ethereum has been in the spotlight lately due to its ongoing developments. The transition to Ethereum 2.0 is a hot topic, and any positive news regarding this could further fuel investment interest. The fact that a whale is betting on Ethereum right now suggests that they might be anticipating favorable developments in the network, which could lead to price appreciation.

UNDERSTANDING LEVERAGE IN CRYPTO TRADING

Now, let’s talk about leverage for a moment. In the world of crypto trading, leverage allows traders to borrow funds to increase their position size. While this can amplify profits, it also increases the risk of loss. A 20X leverage means that for every $1 of their own money, the trader can control $20 in the market. This is a double-edged sword, and understanding how to manage risk while using leverage is crucial for success.

For new traders, it’s essential to approach leverage with caution. While the potential for higher returns is enticing, the risk of significant losses is very real. It’s always wise to have a solid risk management strategy in place, especially when dealing with high-leverage positions.

THE IMPACT OF WHALE MOVEMENTS ON THE CRYPTO MARKET

Whale movements can have a substantial impact on the cryptocurrency market. When large trades occur, they can lead to increased volatility, which can be both a risk and an opportunity for traders. As mentioned earlier, when a whale like the 50X Hyperliquid Whale makes a move, it often influences the behavior of other traders.

For instance, if this whale’s position leads to a price increase, it could trigger a wave of buying from other investors who want to capitalize on the upward momentum. On the flip side, if the trade turns sour, it could lead to panic selling, causing the price to plummet. This creates a unique dynamic in the market that is driven by the actions of a few influential players.

STAYING INFORMED IN THE CRYPTO SPACE

In a fast-paced environment like cryptocurrency trading, staying informed is key. News travels quickly, and being aware of market trends, significant trades, and upcoming developments can give you a competitive edge. Following credible sources on social media, subscribing to newsletters, and engaging with the community can help you stay ahead of the game.

For example, Crypto Rover, the account that broke this news, is known for sharing valuable insights and updates about the crypto market. Keeping an eye on such accounts can provide you with timely information that could influence your trading decisions.

CONSIDERING ETHEREUM’S FUTURE

As this whale enters a long position, many are left wondering what the future holds for Ethereum. With the ongoing developments in the Ethereum ecosystem, including improvements in scalability and transaction speeds, there’s a lot of potential for growth. The transition to Ethereum 2.0 is a significant step that aims to address some of the network’s scalability issues and environmental concerns, making it more appealing to investors.

Additionally, the rise of decentralized finance (DeFi) and non-fungible tokens (NFTs) built on the Ethereum blockchain further solidifies its position as a leader in the crypto space. As more projects emerge and gain traction, it’s likely that Ethereum’s value will continue to be influenced by its ecosystem’s growth.

TAKING ACTION AS A TRADER

So, what can you do as a trader in light of this news? First, consider your own investment strategy. If you’re looking to get involved in Ethereum, it might be wise to do your research and analyze the market trends. Look at the historical price movements, the current market sentiment, and any news that could impact Ethereum’s price.

Also, don’t forget to set realistic goals and have a clear exit strategy. Whether you’re a day trader or a long-term investor, having a plan in place is crucial to navigating the unpredictable world of cryptocurrency.

FINAL THOUGHTS

The return of the 50X Hyperliquid Whale and their substantial investment in Ethereum certainly adds an intriguing layer to the current market landscape. As the community buzzes with speculation and excitement, it’s a reminder of the ever-evolving nature of cryptocurrency trading. Whether you’re an experienced trader or just starting, staying informed and engaged is key to making the most of the opportunities in this dynamic market.