Breaking: Nasdaq-100 & S&P 500 Futures Plummet – Worst Market Drop Since 1987!

.

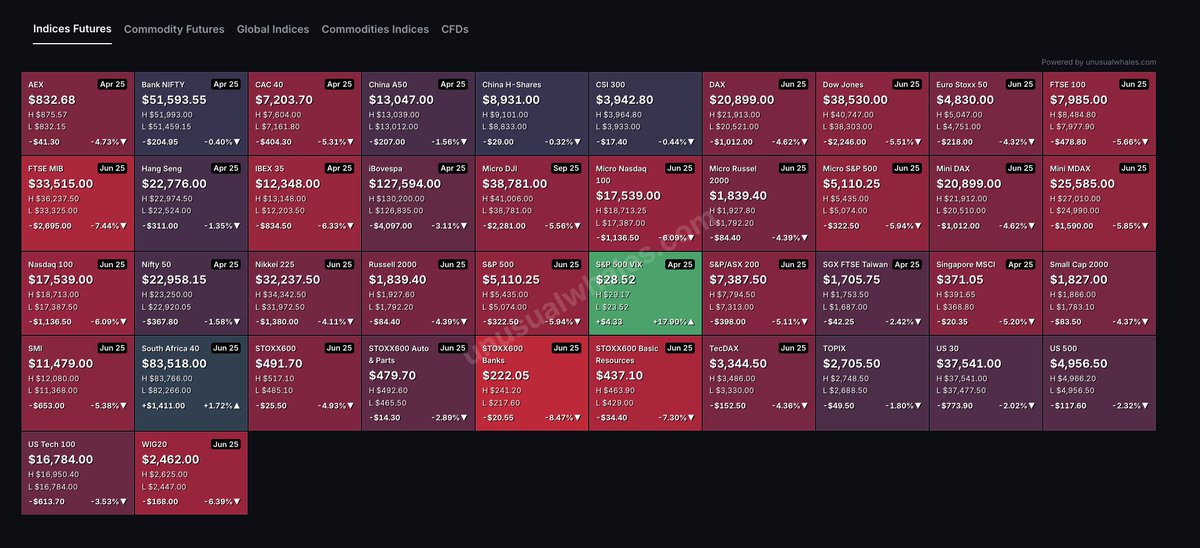

BREAKING: Nasdaq-100 futures down 5.4%, S&P 500 futures down 3.84%

If this holds, this is the worst three day period in the market since 1987, worse than any three day Covid period.

—————–

Market Update: Significant Declines in Nasdaq-100 and S&P 500 Futures

In a startling turn of events in the financial markets, Nasdaq-100 futures have plummeted by 5.4%, while S&P 500 futures have fallen by 3.84%. This downturn is unprecedented, marking the worst three-day period for the stock market since the infamous crash of 1987, surpassing even the tumultuous three-day period during the COVID-19 pandemic.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. : Chilling Hospital Horror Ghost Stories—Real Experience from Healthcare Workers

Understanding the Market Decline

The recent decline in futures indicates a broader sentiment of uncertainty and volatility in the market. Investors are keenly aware of the historical significance of such downturns, especially considering the catastrophic events of 1987, which saw a significant crash in stock prices. The current volatility has raised concerns regarding economic stability, inflation rates, and potential interest rate hikes from the Federal Reserve.

Factors Influencing the Market

Several factors are contributing to this dramatic shift in the market.

- Inflation Concerns: Rising inflation has been a persistent issue, prompting fears of increased interest rates. Investors are particularly sensitive to any signals from the Federal Reserve regarding monetary policy adjustments.

- Geopolitical Tensions: Ongoing geopolitical tensions around the globe have added to investor anxiety. Events that destabilize market confidence can lead to rapid sell-offs, as seen in the current situation.

- Earnings Reports: As companies begin to release their earnings reports for the first quarter, disappointing results can contribute to negative market sentiment. Investors often react swiftly to earnings that fall below expectations.

- Market Sentiment: Overall market sentiment plays a critical role in determining the direction of stock prices. Negative news cycles and investor fear can lead to a self-fulfilling prophecy where prices continue to fall as more investors choose to sell.

Historical Context: The 1987 Crash

The stock market crash of 1987, also known as Black Monday, serves as a stark reminder of how quickly market conditions can change. On October 19, 1987, the Dow Jones Industrial Average fell by over 22% in a single day. The causes of this crash were multi-faceted, including program trading, overvaluation, and market sentiment.

The current market situation mirrors some aspects of the 1987 crash, particularly concerning investor psychology and rapid sell-offs.

Implications for Investors

For investors, the current decline presents both challenges and opportunities.

- Risk Management: Investors should reassess their portfolios and consider risk management strategies. Diversification may help mitigate potential losses during volatile periods.

- Long-Term Strategy: While short-term fluctuations can be unsettling, maintaining a long-term investment strategy is crucial. Historically, markets have rebounded from downturns, and investors who remain patient often reap the rewards.

- Opportunistic Buying: For some investors, declines can present buying opportunities. Identifying fundamentally strong companies that have been unjustly punished by market sentiment can yield significant gains once the market stabilizes.

Future Outlook

Looking ahead, the future of the stock market remains uncertain. Analysts suggest that monitoring economic indicators, Federal Reserve statements, and corporate earnings will be vital for gauging market direction.

Investors should stay informed and be prepared for potential continued volatility as the market adjusts to new economic realities.

Conclusion

In summary, the recent decline in Nasdaq-100 and S&P 500 futures signifies a critical moment in the financial markets. The worst three-day period since 1987 raises questions about economic stability and investor confidence. Understanding the factors at play and preparing for potential outcomes will be essential for navigating this turbulent market landscape. As history has shown, patience and strategic planning can often lead to recovery and growth, even in the face of adversity.

For those invested in the market, staying informed and adaptable will be key to weathering this storm.

BREAKING: Nasdaq-100 futures down 5.4%, S&P 500 futures down 3.84%

If this holds, this is the worst three day period in the market since 1987, worse than any three day Covid period. pic.twitter.com/eUkJTyy4VM

— unusual_whales (@unusual_whales) April 6, 2025

BREAKING: Nasdaq-100 futures down 5.4%, S&P 500 futures down 3.84%

The financial markets have been on a roller coaster ride lately, and today’s news is certainly making headlines. The Nasdaq-100 futures are down a staggering 5.4%, while the S&P 500 futures are following suit with a drop of 3.84%. If these numbers hold, we’re looking at the worst three-day period in the market since 1987. Yes, you read that right—worse than any three-day stretch we experienced during the COVID period. This is a significant moment for investors, traders, and anyone keeping an eye on the economic landscape.

If you’re wondering what could be behind this drastic decline, you’re not alone. The market is often influenced by a variety of factors, including economic indicators, geopolitical tensions, and changes in consumer behavior. Today, concerns about inflation, interest rates, and global economic stability are all playing a role in this downward spiral.

If this holds, this is the worst three-day period in the market since 1987

To put things into perspective, let’s take a trip down memory lane. The market crash of 1987, often referred to as Black Monday, saw the Dow Jones Industrial Average plummet by over 22% in a single day. Many investors are understandably anxious about the current situation, as it evokes memories of that turbulent time. While the market has its ups and downs, this kind of decline within just three days is alarming and reminiscent of some of the worst days in financial history.

The volatility we’re witnessing is not just a number on a screen; it has real-world implications. Investors are feeling the pressure as portfolios shrink, and many are reevaluating their strategies. Are you one of those investors? If so, it’s crucial to stay informed and consider your options carefully.

worse than any three-day Covid period

The COVID-19 pandemic shook the world in unprecedented ways, and the stock market was no exception. Many remember the panic and uncertainty that gripped investors during the initial outbreak, leading to massive sell-offs. However, the current situation is proving to be even more severe, with losses that are outpacing those dark days.

Experts are analyzing the market’s responses and attributing these losses to a confluence of factors. Rising inflation rates, interest hikes, and ongoing supply chain issues are creating a perfect storm for investors. If you’re looking for more insights, you can check out detailed analyses on platforms like [MarketWatch](https://www.marketwatch.com/) and [CNBC](https://www.cnbc.com/).

The Impact on Investors

So what does this mean for you as an investor? If you’re feeling overwhelmed, you’re not alone. Many investors are grappling with the idea of whether to hold onto their investments or cut their losses. It’s a tough decision, and one that requires careful consideration.

One approach is to diversify your portfolio. If you’ve primarily invested in tech stocks, for instance, this might be the time to explore other sectors like healthcare, utilities, or consumer goods. Diversification can help cushion your investments against market volatility.

Another option is to consult with a financial advisor who can provide personalized advice based on your financial situation and goals. Websites like [NerdWallet](https://www.nerdwallet.com/) can help you find reputable advisors in your area.

Looking Ahead: What’s Next?

As we navigate through this turbulent time, it’s essential to keep an eye on the horizon. Market conditions can change rapidly, and staying informed will empower you to make better decisions. Watch for updates on economic indicators, government policies, and global events that could influence the market.

While today’s numbers are disheartening, remember that market downturns are often followed by recoveries. History has shown us that markets can bounce back, and patience can pay off in the long run.

Don’t forget to leverage resources like [Yahoo Finance](https://finance.yahoo.com/) and [Bloomberg](https://www.bloomberg.com/) for real-time updates and analysis.

Final Thoughts

Today’s breaking news about the Nasdaq-100 futures down 5.4% and S&P 500 futures down 3.84% serves as a stark reminder of the volatility inherent in financial markets. As we face what could be the worst three-day period since 1987, it’s important to approach your investment strategy with caution and awareness.

Stay informed, consider your options, and don’t hesitate to seek professional advice if needed. Remember, every market downturn can also be an opportunity to reassess and reposition yourself for future growth. Whether you’re a seasoned investor or just starting out, keeping a cool head in times of uncertainty is crucial.