Breaking: New US Tariff Strategy Revealed! Discover How Trade Deficits Shape Import Costs

.

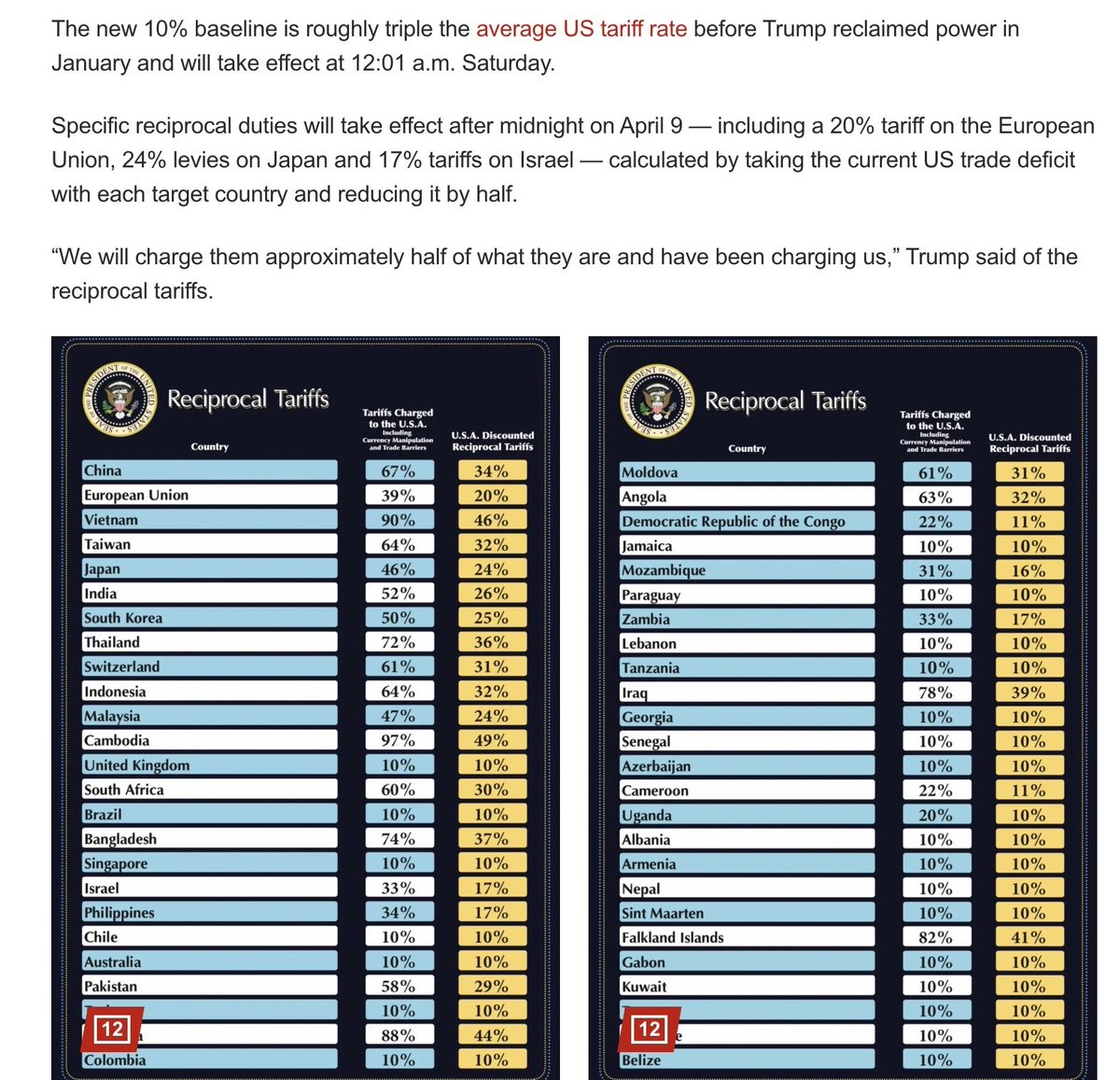

JUST IN: The NYPost has reported that the US tariffs on each nation is calculated by taking the current US trade deficit with each target country and dividing the deficit by half, to get the resulting tariff imposed.

—————–

US Tariffs Explained: Understanding the Calculation Method

In a recent report by the New York Post, an interesting methodology behind the imposition of tariffs by the United States has come to light. The report, shared via Twitter by user @unusual_whales, reveals that the US calculates tariffs on various nations by analyzing the current trade deficit with each country. This calculation involves a straightforward formula: the trade deficit is divided by half to determine the tariff imposed.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. : Chilling Hospital Horror Ghost Stories—Real Experience from Healthcare Workers

The Significance of Trade Deficits

Trade deficits occur when a country imports more goods and services than it exports. This economic imbalance can have significant implications for national policy, particularly in terms of tariffs and trade agreements. By basing tariffs on trade deficits, the US aims to address perceived inequities in trade relationships and encourage a more balanced exchange of goods.

The Tariff Calculation Process

The methodology reported implies a systematic approach to tariff imposition. For instance, if the US has a trade deficit of $100 billion with a particular country, the resulting tariff would be $50 billion after applying the formula of dividing the deficit by two. This approach is intended to directly target nations contributing to the trade imbalance, making tariffs a tool for economic negotiation and adjustment.

Implications for International Trade

The implications of this methodology are profound. Governments and economies worldwide closely monitor US tariff policies, as they can significantly influence global trade dynamics. Countries facing high tariffs may seek to renegotiate trade agreements or adjust their export strategies to mitigate the financial impact.

The Role of Tariffs in Economic Policy

Tariffs serve multiple purposes in economic policy. They can protect domestic industries from foreign competition, generate revenue for governments, and influence consumer behavior. However, excessive tariffs may lead to trade wars, where affected countries retaliate with their tariffs, leading to an escalation of tensions and potential economic downturns.

Recent Trends in Tariff Implementation

The use of tariffs has become a central theme in US trade policy, especially during periods of economic uncertainty. The reported method of calculating tariffs based on trade deficits aligns with a broader trend of using tariffs as leverage in international negotiations. By quantifying the trade deficit and imposing corresponding tariffs, the US government signals its intent to rectify trade imbalances.

Conclusion: Understanding the Impact of Tariffs

The revelation regarding the calculation of US tariffs sheds light on the underlying rationale for these economic measures. By adopting a formulaic approach based on trade deficits, the US aims to foster more equitable trade relationships and address economic disparities. As global trade continues to evolve, understanding the mechanisms behind tariff policies will be crucial for businesses, policymakers, and economists alike.

In summary, the methodology for calculating US tariffs based on trade deficits offers a strategic framework for addressing international trade imbalances. As countries navigate the complexities of global trade, the implications of these tariffs will continue to shape economic relationships and influence market dynamics. Engaging with these policies is essential for anyone invested in the global economy, ensuring informed decisions in a rapidly changing landscape.

JUST IN: The NYPost has reported that the US tariffs on each nation is calculated by taking the current US trade deficit with each target country and dividing the deficit by half, to get the resulting tariff imposed. pic.twitter.com/wHXeOli9b6

— unusual_whales (@unusual_whales) April 3, 2025

JUST IN: The NYPost has reported that the US tariffs on each nation is calculated by taking the current US trade deficit with each target country and dividing the deficit by half, to get the resulting tariff imposed.

The world of international trade can be a bit of a maze, and tariffs are one of those crucial elements that can significantly impact the economy. Recently, the NYPost shared a fascinating insight into how the United States calculates tariffs on various countries. According to their report, the tariffs imposed on each nation are derived from the current US trade deficit with that country, which is divided by half to determine the resulting tariff. This method might sound straightforward, but it opens up a wider conversation about trade relations and the economic implications for both the US and its trading partners.

Understanding the Basics of US Tariffs

So, what exactly are tariffs? In simple terms, tariffs are taxes imposed on imported goods. They are used by governments to control the flow of goods and services across borders, protect domestic industries, and sometimes to retaliate against trade practices deemed unfair. The recent revelation about how these tariffs are calculated shines a light on the underlying economic strategies at play. By taking the current trade deficit and dividing it by half, the US is essentially attempting to level the playing field with nations that have been running a trade surplus with it.

This approach raises some eyebrows—after all, is it fair to impose tariffs based on a deficit? It suggests that the US is not just reacting to trade practices but actively measuring its economic standing against other nations. The method of calculation could lead to a significant increase in tariffs, potentially affecting consumer prices and international relations.

The Impact of Tariffs on Trade Relationships

When tariffs are implemented, they can have a ripple effect on trade relationships. For instance, countries that find themselves on the receiving end of these tariffs may retaliate by imposing their own tariffs, creating a tit-for-tat scenario. This not only disrupts trade but can also lead to a trade war, which can be detrimental to both economies involved.

The calculation method mentioned in the NYPost report could exacerbate these tensions. By using the trade deficit as a basis for tariffs, the US may inadvertently provoke countries that feel they are being unfairly targeted. This could lead to strained diplomatic relations and a decrease in bilateral trade. It’s essential to consider how these tariffs affect not just the economy but also the broader geopolitical landscape.

The Economic Rationale Behind Tariff Calculations

The rationale behind calculating tariffs based on trade deficits is rooted in the desire to protect domestic industries. The US government aims to support American businesses and jobs by making foreign goods more expensive. This can encourage consumers to buy domestically produced products. However, the effectiveness of such a strategy is often debated. While it may offer short-term relief to certain industries, it can also lead to longer-term challenges, such as increased consumer prices and limited choices for shoppers.

Moreover, the method of dividing the trade deficit by half raises questions about its effectiveness. Is this approach truly reflective of the complexities of international trade? Trade deficits can be influenced by numerous factors, including currency strength, demand for goods, and economic policies in other countries. Simplifying the calculation to a half-deficit model may overlook these nuances, leading to oversimplified trade policies that could have unintended consequences.

The Role of Public Perception and Political Influence

Public perception plays a crucial role in how tariffs are viewed and accepted. Many Americans may support tariffs if they believe they will protect local jobs and industries. However, if prices rise as a result of these tariffs, public sentiment can quickly shift. The political ramifications of imposing tariffs based on trade deficits can also not be ignored. Politicians may use the narrative of protecting American jobs to rally support, but they must also consider the potential backlash from consumers facing higher prices.

Additionally, the influence of lobbyists and special interest groups cannot be underestimated. Industries that benefit from tariffs may push for more stringent measures, while those that are negatively affected may advocate for free trade policies. This tug-of-war can complicate the implementation of a coherent trade strategy.

Looking Ahead: The Future of US Tariffs

As the global economy evolves, so too will the methods of calculating tariffs. The approach highlighted in the NYPost’s report could be a starting point for broader discussions about trade practices and economic policy. It’s essential for policymakers to remain flexible and responsive to changes in the global market.

Future tariffs may not only depend on trade deficits but also on considerations such as environmental impacts, labor practices, and technological advancements. A more comprehensive approach to tariffs could lead to a more balanced and fair trade environment.

In summary, the revelation from the NYPost about how US tariffs are calculated sheds light on the complex world of international trade. By understanding the implications of using trade deficits as a basis for tariffs, we can better appreciate the economic and political factors at play. Whether you’re a consumer, a business owner, or simply someone interested in the economy, staying informed about these developments is crucial in navigating the ever-changing landscape of global trade.