Trump Tariff Tax: America’s Biggest Peacetime Hike Costing Families $3,500 Annually!

.

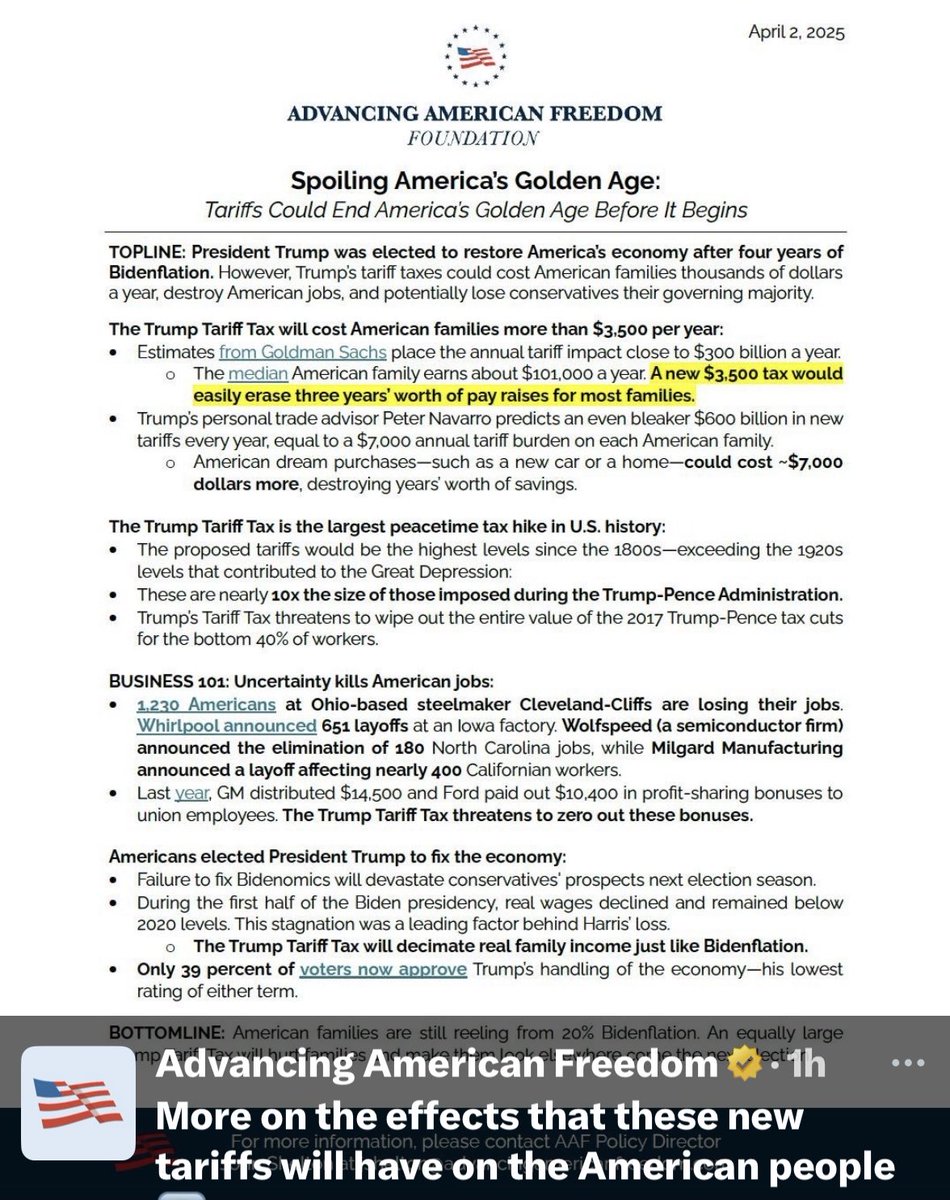

The Trump Tariff Tax is the largest peacetime tax hike in U.S. history. These Tariffs are nearly 10x the size of those imposed during the Trump-Pence Administration and will cost American families over $3,500 per year. Check Out“Spoiling America’s Golden Age”@AmericanFreedom

—————–

The Trump Tariff Tax: A Historic Financial Burden on American Families

In a recent tweet, former Vice President Mike Pence highlighted the significant impact of the Trump Tariff Tax, which he claims to be the largest peacetime tax hike in U.S. history. According to Pence, these tariffs are nearly ten times larger than those imposed during the Trump-Pence Administration. The financial implications of these tariffs are staggering, with estimates suggesting that American families could face an annual cost increase exceeding $3,500.

Understanding the Trump Tariff Tax

The Trump Tariff Tax refers to a series of tariffs that have been implemented on various goods imported into the United States. Tariffs are essentially taxes imposed on imported products, making them more expensive and potentially affecting the prices consumers pay for these goods. The objective behind imposing tariffs is often to protect domestic industries by making imported products less competitive in price.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. : Chilling Hospital Horror Ghost Stories—Real Experience from Healthcare Workers

Pence’s assertion that these tariffs represent the largest peacetime tax hike underscores the scale and significance of this economic policy. Tariffs can lead to increased costs not just for businesses that rely on imported materials but also for consumers who purchase finished goods that incorporate these materials. As a result, households across the nation may feel the pinch in their budgets, as everyday items may see price hikes.

The Economic Impact on Families

The claim that American families will incur an additional cost of over $3,500 annually due to these tariffs is alarming. This figure encapsulates the broader economic ramifications of the tariff policy, indicating that the financial burden will disproportionately affect middle-class families. With rising costs of living, many households are already facing budgetary constraints, making the additional expenses from tariffs a significant concern.

Increased costs from tariffs can lead to decreased consumer spending, which could slow down economic growth. If families are forced to allocate more of their income to pay for essential goods, they may have less to spend on discretionary items, which can further impact businesses and the overall economy.

Broader Policy Considerations

The tweet encourages individuals to explore more about the implications of the Trump Tariff Tax through the referenced source, “Spoiling America’s Golden Age.” This indicates a broader discourse regarding the long-term effects of tariff policies and their role in shaping the American economy. The conversation surrounding tariffs often includes debates about trade relations, the balance of power in global markets, and the potential for retaliatory measures from other countries.

Conclusion: A Call for Awareness

Mike Pence’s tweet serves as a call for awareness among American families regarding the economic implications of the Trump Tariff Tax. As these tariffs become a point of contention in political discourse, understanding their impact is crucial for consumers and policymakers alike. The potential annual cost increase of over $3,500 is a stark reminder of how trade policies can directly affect the financial well-being of everyday Americans.

As the discussion continues, it remains vital for families to stay informed about economic policies that may impact their lives and to advocate for solutions that prioritize their interests. Engaging in this dialogue will be essential for shaping a more equitable economic future.

The Trump Tariff Tax is the largest peacetime tax hike in U.S. history. These Tariffs are nearly 10x the size of those imposed during the Trump-Pence Administration and will cost American families over $3,500 per year. Check Out“Spoiling America’s Golden Age”@AmericanFreedom pic.twitter.com/2NghyDc8c1

— Mike Pence (@Mike_Pence) April 2, 2025

The Trump Tariff Tax is the Largest Peacetime Tax Hike in U.S. History

When it comes to tax policy, few topics ignite more debate than tariffs. Recently, Mike Pence took to Twitter to share a critical message about the Trump Tariff Tax, which he claims is “the largest peacetime tax hike in U.S. history.” This statement raises eyebrows and leaves many wondering how this tax hike will impact American families. In a world where economic stability is crucial, understanding the implications of such tariffs is vital.

The Trump Tariff Tax, as Pence suggests, is a staggering step that some estimate to be nearly ten times the size of tariffs imposed during the Trump-Pence Administration. This jump in tariffs is projected to cost American families over $3,500 each year. So, what does this mean for everyday Americans?

Understanding Tariffs and Their Impact

At its core, a tariff is a tax imposed on imported goods. When tariffs increase, the cost of imported products rises, which can lead to higher prices for consumers. This trickle-down effect means that everyday items, from electronics to clothing, can become significantly more expensive. For many families, the additional $3,500 a year might mean tighter budgets and difficult choices.

Economists argue that while tariffs aim to protect American manufacturers, they can often lead to unintended consequences. By increasing the cost of imported goods, tariffs can stifle competition, leading to higher prices for consumers. In the long run, this can hurt the very workers the tariffs aim to protect.

If you want to dive deeper into the implications of these tariffs, you can check out [American Freedom’s coverage](https://twitter.com/AmericanFreedom) on the topic, which discusses the broader economic ramifications and offers insights into whether such policies truly benefit American families.

The Historical Context of Tariffs

To fully grasp the current landscape, it’s essential to look at the historical context of tariffs in the United States. Tariffs have been a part of U.S. policy for centuries, initially designed to protect fledgling American industries from foreign competition. However, the debate around tariffs has evolved significantly, especially in recent decades.

During the Trump-Pence Administration, tariffs were indeed a hot topic, but they were not nearly as expansive as the ones being discussed now. The previous administration’s tariffs primarily targeted specific sectors, such as steel and aluminum, and were often met with mixed reactions from both the public and lawmakers.

Today, as Pence highlights, we are facing a new wave of tariffs that are projected to dwarf those previous efforts. The scale of this tax hike raises questions about its effectiveness and long-term sustainability. Are these tariffs truly a protective measure, or are they setting the stage for economic turmoil?

What This Means for American Families

The implications of the Trump Tariff Tax are profound. If families are indeed facing an additional $3,500 in expenses each year due to these tariffs, the impact will be felt in various areas of daily life. From the grocery store to the gas station, higher prices can strain family budgets, forcing people to reconsider their spending habits.

Moreover, the potential for job losses in industries reliant on imported goods could further exacerbate economic challenges. When businesses face higher costs due to tariffs, they often pass those costs onto consumers, which can lead to reduced sales and even layoffs. The cycle can be vicious, and it’s crucial for families to be aware of how these tariffs may affect their financial security.

For more insights on how tariffs are reshaping the American economy, you can visit [American Freedom’s analysis](https://twitter.com/AmericanFreedom) of the situation and explore their take on how these policies might “spoil America’s golden age.”

Is There a Path Forward?

Given the complexities surrounding tariffs and their implications, many are left wondering if there’s a viable path forward. Policymakers need to consider alternative approaches that protect American workers without burdening families with increased costs.

One alternative could be investing in domestic industries directly, providing incentives for innovation and growth without resorting to punitive tariffs. By fostering a competitive environment, the U.S. can support its workers while maintaining fair prices for consumers.

Advocating for fair trade agreements that prioritize American interests without imposing steep tariffs may also prove beneficial. These agreements can help level the playing field while encouraging cooperation and mutual benefits among trading partners.

In light of these challenges, it’s crucial for families to stay informed and engaged in discussions about tariffs and their implications. Understanding the economic landscape can empower individuals to advocate for policies that truly serve their interests.

Conclusion

The Trump Tariff Tax brings with it a complex web of economic consequences that could significantly impact American families. With projections suggesting a cost burden of over $3,500 per year, the stakes are high. As debates continue, it’s essential for individuals to stay informed and engaged.

By exploring diverse perspectives and understanding the implications of these policies, families can better navigate the evolving economic landscape. For more information and to stay updated on this evolving situation, keep an eye on platforms like [American Freedom](https://twitter.com/AmericanFreedom) that provide ongoing analysis and insights.

The conversation about tariffs is far from over, and your voice matters in shaping the future of economic policy in the U.S.