BREAKING: Japanese Company Metaplanet Buys 160 Bitcoin for 2 Billion Yen – Whales are Loading Up!

.

BREAKING

JAPANESE COMPANY METAPLANET

JUST BOUGHT 160 BITCOIN FOR

2 BILLION YEN.

WHALES ARE LOADING UP

—————–

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. : Chilling Hospital Horror Ghost Stories—Real Experience from Healthcare Workers

Japanese Company Metaplanet Acquires 160 Bitcoin for 2 Billion Yen

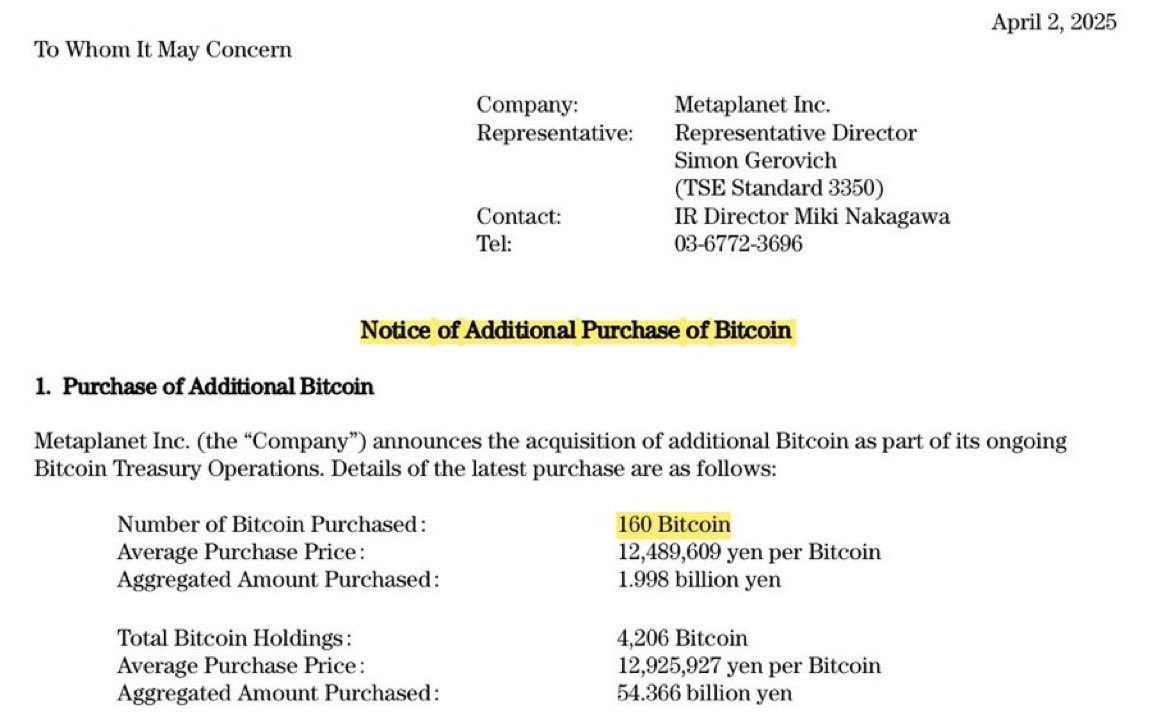

In a significant move that has captured the attention of the cryptocurrency community and investors alike, Japanese company Metaplanet has announced its acquisition of 160 Bitcoin for a staggering 2 billion yen. This strategic investment highlights the growing interest and confidence in Bitcoin as a valuable asset, especially among institutional investors and high-net-worth individuals, commonly referred to as "whales."

Implications of the Acquisition

The purchase reflects a broader trend where major players in the market are increasingly adding Bitcoin to their portfolios. With the recent fluctuations in the cryptocurrency market, this acquisition could be seen as a bullish signal. The decision by Metaplanet to invest heavily in Bitcoin not only reinforces the asset’s position as a leading digital currency but also showcases the potential for future growth, making it an attractive option for investors looking for long-term value.

The Rise of Institutional Investment in Bitcoin

Institutional investment in Bitcoin has surged over the past few years, with companies like Tesla, MicroStrategy, and now Metaplanet leading the charge. These investments are often seen as a vote of confidence in Bitcoin’s future, especially as more companies and individuals recognize the potential of cryptocurrencies as a hedge against inflation and economic instability. The move by Metaplanet is particularly noteworthy as it underlines the increasing acceptance of Bitcoin in traditional financial markets.

Why Whales Are Loading Up on Bitcoin

The term "whales" refers to individuals or entities that hold large amounts of cryptocurrency. Their buying patterns can significantly impact market prices and trends. In this case, Metaplanet’s purchase of 160 Bitcoin is indicative of a larger trend where whales are acquiring Bitcoin at a time when prices are perceived to be favorable. This accumulation strategy is often based on the belief that Bitcoin will continue to rise in value, driven by factors such as limited supply, growing adoption, and increased demand.

Market Reactions and Future Predictions

Following the announcement of Metaplanet’s acquisition, the cryptocurrency market has been buzzing with speculation about what this could mean for Bitcoin’s price trajectory. Analysts are closely monitoring market movements, and many are optimistic that this purchase could lead to a bullish trend in the near future. As more companies follow in Metaplanet’s footsteps, the demand for Bitcoin may further increase, potentially leading to price surges.

Moreover, the timing of this investment is crucial. With Bitcoin often viewed as a digital gold, investors are seeking refuge in its perceived stability amidst global financial uncertainties. The confidence shown by Metaplanet could encourage other companies to consider similar investments, further solidifying Bitcoin’s status as a cornerstone of the cryptocurrency market.

Conclusion

Metaplanet’s acquisition of 160 Bitcoin for 2 billion yen marks a pivotal moment in the cryptocurrency landscape, showcasing the growing institutional interest in digital assets. As whales continue to load up on Bitcoin, the implications for market dynamics and future price movements are significant. Investors and analysts alike will be watching closely to see how this strategic investment influences the broader cryptocurrency market in the coming months. With the increasing acceptance of Bitcoin and its potential for future growth, now may be the time for individuals and institutions to consider their positions in this evolving digital economy.

BREAKING

JAPANESE COMPANY METAPLANET

JUST BOUGHT 160 BITCOIN FOR

2 BILLION YEN.WHALES ARE LOADING UP pic.twitter.com/GxzO5CIqWt

— Ash Crypto (@Ashcryptoreal) April 2, 2025

BREAKING

In an exciting turn of events for the cryptocurrency world, Japanese company Metaplanet has made headlines by purchasing a whopping 160 Bitcoin for a staggering 2 billion yen. This bold move has sent ripples through the crypto community, igniting discussions about what this means for Bitcoin’s future and the broader market dynamics. Whales are loading up, and it’s a sight to behold!

JAPANESE COMPANY METAPLANET

Metaplanet, a rising star in the tech industry, has made a significant investment that reflects their confidence in Bitcoin. As one of the most recognized digital currencies, Bitcoin has seen its fair share of ups and downs, yet its allure continues to attract major players. The purchase of 160 Bitcoin is not just a financial transaction; it’s a statement of intent and belief in the long-term value of cryptocurrency.

Investors are keenly watching Metaplanet’s moves, as this could set a precedent for other companies considering similar investments. The company’s strategic decision to dive into Bitcoin showcases their forward-thinking approach and willingness to embrace the evolving financial landscape. For those unfamiliar with the dynamics of cryptocurrency investments, this is a clear signal that institutional interest is growing, which often leads to increased market stability and potential price surges.

JUST BOUGHT 160 BITCOIN FOR

When we break down the investment, the 160 Bitcoin purchase for 2 billion yen translates to an average price of around 12.5 million yen per Bitcoin. This price point has sparked discussions about market valuation and the potential for future price increases. With Bitcoin’s history of volatility, many are pondering whether Metaplanet’s timing is spot-on or if they’re jumping in just before a correction.

The fact that a major company is willing to invest such a large sum in Bitcoin indicates a growing trend among institutional investors. Over the past few years, we’ve witnessed a shift where large corporations and financial institutions are no longer shying away from cryptocurrencies. Instead, they’re embracing them as an essential part of their investment portfolios.

2 BILLION YEN

2 billion yen is not just pocket change; it’s a significant commitment that underlines Metaplanet’s belief in Bitcoin as a long-term asset. This purchase could potentially lead to increased interest from other companies, as they may now view Bitcoin as a legitimate investment opportunity rather than a speculative gamble. The market’s reaction to this news has been overwhelmingly positive, with Bitcoin’s price seeing an uptick as traders and investors respond to the news.

Many experts believe that purchases like Metaplanet’s can act as a catalyst for further adoption of Bitcoin and other cryptocurrencies. As more companies see the potential benefits of holding Bitcoin, we could witness a snowball effect, leading to greater liquidity and stability in the market.

WHALES ARE LOADING UP

The term “whales” refers to individuals or entities that hold large quantities of cryptocurrency. The fact that whales are loading up on Bitcoin right now speaks volumes about the current market sentiment. These whales often have the power to influence market movements due to the size of their transactions. When they make substantial purchases, it can create a sense of urgency among smaller investors, prompting them to buy in before prices rise further.

With Metaplanet’s recent acquisition, it’s likely that other whales are taking note. This could lead to a surge in activity as large players position themselves ahead of what they anticipate will be a bullish market trend. The excitement is palpable, with many in the crypto community speculating about the implications of such large-scale investments.

Furthermore, the involvement of whales often leads to increased media attention, which can help drive public interest in cryptocurrencies. As more people become aware of Bitcoin and its potential, we may see a new wave of retail investors entering the market, further fueling the momentum.

What This Means for the Future of Bitcoin

Looking ahead, Metaplanet’s purchase could be seen as a bellwether for the cryptocurrency market. As institutional interest in Bitcoin continues to grow, we can expect more companies to follow suit, exploring the benefits of crypto investments. This could lead to increased price stability and, potentially, upward price pressure as supply diminishes and demand surges.

Moreover, as Bitcoin becomes more integrated into traditional financial systems, we might witness a shift in how the general public perceives cryptocurrencies. The stigma surrounding digital currencies is gradually dissipating, making way for a more mainstream acceptance. This evolution could redefine how we view money, investments, and even the global economy.

Final Thoughts

Metaplanet’s recent purchase of 160 Bitcoin for 2 billion yen is a significant event that signals a growing confidence in the cryptocurrency market. With whales loading up and institutional investors stepping in, the landscape for Bitcoin is changing rapidly. Whether you’re a seasoned investor or just curious about the world of crypto, keeping an eye on these developments could provide valuable insights into the future of finance. So, buckle up and get ready for an exciting ride in the world of Bitcoin!

To stay updated on the latest cryptocurrency news and trends, don’t forget to follow reliable sources and engage with the community. The crypto world is always evolving, and being informed is key to making the best decisions!