JUST IN: Tether Acquires 8,888 Bitcoin for $735M, Boosting Holdings to Over 100,000 BTC!

.

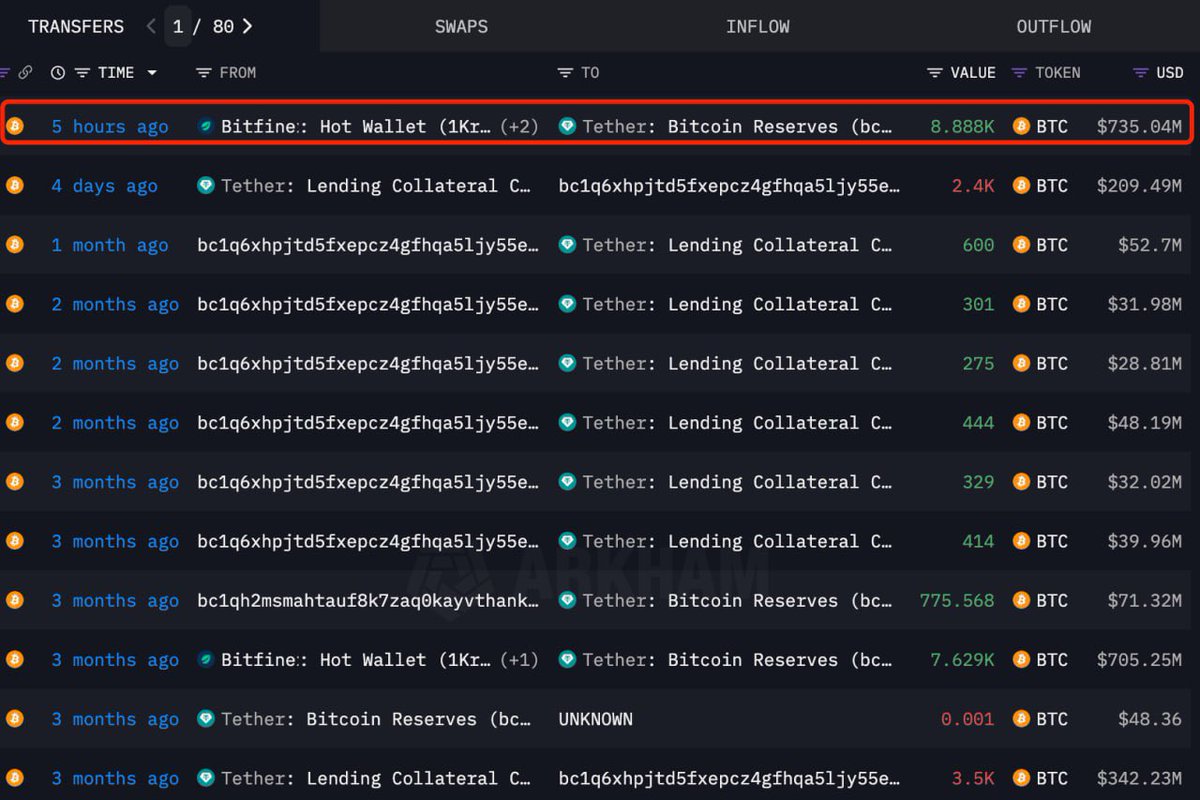

JUST IN: Stablecoin issuer Tether buys 8,888 Bitcoin worth $735 million as per on-chain data.

They now hold over 100,000 BTC

—————–

Tether’s Major Bitcoin Acquisition: What You Need to Know

In a significant move that has caught the attention of the cryptocurrency community, Tether, the issuer of the popular stablecoin USDT, has recently acquired a staggering 8,888 Bitcoin (BTC) for approximately $735 million. This purchase, confirmed through on-chain data, is indicative of Tether’s growing confidence in Bitcoin as a long-term asset. Following this acquisition, Tether now holds over 100,000 BTC, positioning itself as one of the largest holders of Bitcoin globally.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. : Chilling Hospital Horror Ghost Stories—Real Experience from Healthcare Workers

The Implications of Tether’s Bitcoin Purchase

Tether’s decision to acquire such a large quantity of Bitcoin has multifaceted implications for both the cryptocurrency market and the broader financial landscape. As a stablecoin issuer, Tether’s move may signal a shift in how digital assets are perceived and utilized, particularly in the context of stablecoins and their role in the crypto economy.

The purchase is particularly notable given the ongoing debates surrounding the stability and regulation of stablecoins. By holding a significant amount of BTC, Tether may be looking to bolster its reserves and provide a more solid backing for USDT, which is crucial for maintaining its peg to the U.S. dollar. This could help instill greater confidence among users and investors in the stability and reliability of USDT.

Market Reactions and Future Trends

The cryptocurrency market reacted positively to the news of Tether’s acquisition. Analysts suggest that this could lead to increased buying pressure on Bitcoin, potentially driving prices higher in the short term. As Tether continues to accumulate Bitcoin, it may influence market dynamics by reducing the available supply of BTC on exchanges, which could further contribute to upward price movements.

Moreover, Tether’s acquisition highlights the ongoing trend of institutional interest in Bitcoin. As more companies and organizations recognize the potential of Bitcoin as a store of value, the demand for BTC is likely to increase. This trend may also encourage other stablecoin issuers to consider similar strategies, potentially leading to a more significant shift in how stablecoins are backed and utilized in the financial system.

What This Means for Investors

For investors, Tether’s acquisition of Bitcoin presents both opportunities and challenges. On one hand, the increased institutional interest in Bitcoin could lead to greater adoption and a more stable price environment. On the other hand, the volatility that often accompanies such large transactions can create uncertainty in the market.

Investors should keep a close eye on Tether’s future activities and the broader implications for the cryptocurrency market. As Tether continues to hold and possibly acquire more Bitcoin, it could play a pivotal role in shaping the future of digital currencies.

Conclusion

Tether’s recent purchase of 8,888 Bitcoin for $735 million marks a significant milestone in the ongoing evolution of the cryptocurrency landscape. As the company now holds over 100,000 BTC, the implications of this acquisition reach far beyond Tether itself, influencing market dynamics and investor sentiment. As institutional interest in Bitcoin grows, the cryptocurrency market may witness transformative changes, making it an exciting time for both seasoned investors and newcomers alike.

Stay informed about Tether’s developments and the evolving cryptocurrency market to make well-informed investment decisions. With Tether’s strategic moves, the landscape of digital assets continues to shift, promising a future filled with potential.

JUST IN: Stablecoin issuer Tether buys 8,888 Bitcoin worth $735 million as per on-chain data.

They now hold over 100,000 BTC pic.twitter.com/8lb8G2WOZ5

— Bitcoin Magazine (@BitcoinMagazine) April 1, 2025

JUST IN: Stablecoin issuer Tether buys 8,888 Bitcoin worth $735 million as per on-chain data

The cryptocurrency world is buzzing with excitement as Tether, the company behind the well-known stablecoin USDT, has made headlines by acquiring a whopping 8,888 Bitcoin for $735 million. This strategic move, revealed through on-chain data, marks a significant milestone for Tether, as they now hold over 100,000 BTC. This news highlights Tether’s growing influence in the blockchain space and raises questions about the future of Bitcoin and stablecoins alike.

What Does This Acquisition Mean for Tether?

By purchasing 8,888 Bitcoin, Tether is clearly signaling its confidence in the long-term value of Bitcoin. For those who might be unfamiliar, Tether operates as a stablecoin issuer, allowing users to transact in a digital currency that is pegged to the value of the U.S. dollar. This recent acquisition not only strengthens Tether’s reserves but also positions the company as a major player in the cryptocurrency market. With over 100,000 BTC now in its portfolio, Tether is solidifying its reputation and influence within the crypto ecosystem.

The Implications for Bitcoin’s Price

When a company like Tether makes such a substantial investment in Bitcoin, it inevitably stirs up discussions about Bitcoin’s price trajectory. Many analysts believe that large purchases can lead to upward pressure on Bitcoin’s price. Given that Tether has a reputation for being closely tied to market movements, this acquisition could potentially lead to increased demand for Bitcoin, further driving its price up. As we’ve seen in the past, significant buying activity often results in bullish sentiment, making this acquisition one to watch.

Stablecoins and Their Role in the Crypto Market

Stablecoins like Tether’s USDT play a crucial role in the cryptocurrency market. They provide a bridge between the volatile world of digital assets and the stability of traditional currencies. Tether’s latest move to acquire Bitcoin only emphasizes the importance of stablecoins in the crypto ecosystem. As more investors seek refuge from the volatility of cryptocurrencies, stablecoins offer a safe haven where they can hold their assets without worrying about drastic price fluctuations.

On-Chain Data: The New Frontier for Transparency

The mention of on-chain data in Tether’s announcement is particularly noteworthy. On-chain data refers to the information recorded on the blockchain that provides transparency into transactions and holdings. This kind of data allows anyone to verify Tether’s Bitcoin holdings, which is essential for building trust among users. With growing scrutiny in the crypto space regarding transparency and legitimacy, initiatives like these help reinforce confidence in Tether’s operations and its commitment to maintaining a trustworthy stablecoin.

The Future of Tether and Bitcoin

As Tether continues to diversify its holdings with significant investments in Bitcoin, the future looks promising for both entities. Tether’s strategy of accumulating Bitcoin could pave the way for further innovations, including the potential for new financial products and services. Furthermore, as the crypto landscape evolves, Tether’s actions may influence other stablecoin issuers to follow suit, leading to a potential shift in how stablecoins interact with cryptocurrencies.

The Community’s Reaction

The crypto community’s reaction to Tether’s recent acquisition has been overwhelmingly positive. Many enthusiasts view it as a strong endorsement of Bitcoin, reaffirming its status as a leading digital asset. Social media platforms are ablaze with discussions and analyses about the implications of Tether’s move, showcasing the excitement and engagement within the community.

Conclusion: The Changing Landscape of Cryptocurrency

Tether’s acquisition of 8,888 Bitcoin worth $735 million is a pivotal moment in the cryptocurrency space. It highlights the growing interplay between stablecoins and cryptocurrencies like Bitcoin. As Tether now holds over 100,000 BTC, the implications for both their future and the broader market are significant. The strategic move signifies confidence in Bitcoin’s potential and may lead to increased interest and investment in the digital asset space.

For those looking to stay updated on the latest developments in cryptocurrency, following news outlets such as Bitcoin Magazine can provide valuable insights into market trends and shifts. As the landscape continues to change, keeping an eye on major players like Tether will be key to understanding the future of digital finance.