Urgent: U.S. Crypto Investors – File 2024 Taxes by April 15, 2025! Know Taxable Events Now!

.

JUST IN: U.S. crypto investors must file their 2024 tax returns by April 15, 2025, reporting all taxable events like sales, trades, staking, and airdrops.

—————–

As of March 31, 2025, U.S. crypto investors are reminded of their obligation to file their tax returns by April 15, 2025. This filing is crucial for reporting all taxable events related to cryptocurrency transactions, including sales, trades, staking, and airdrops. The announcement, shared by Cointelegraph, highlights the importance of compliance with IRS regulations for individuals involved in the burgeoning crypto market.

## Understanding Taxable Events in Cryptocurrency

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. : Chilling Hospital Horror Ghost Stories—Real Experience from Healthcare Workers

In the realm of cryptocurrency, a “taxable event” is any occurrence that can trigger tax implications. For U.S. investors, this includes selling cryptocurrencies for profit, trading one cryptocurrency for another, earning from staking rewards, and receiving airdrops of new tokens. It’s essential for investors to maintain meticulous records of all their transactions, as these details will be necessary when preparing their tax returns.

### The Importance of Accurate Reporting

Accurate reporting of cryptocurrency transactions is vital for several reasons. First, the IRS has been increasingly vigilant in monitoring crypto transactions and ensuring compliance. Failure to report taxable events can lead to audits, penalties, and even legal consequences. By keeping thorough records, investors can accurately report their income and avoid potential issues with tax authorities.

### Key Dates and Deadlines

As indicated, the deadline for filing tax returns for the 2024 tax year is April 15, 2025. Investors should mark this date in their calendars and start preparing their documentation well in advance. Gathering transaction records, including dates, amounts, and the nature of each transaction, will streamline the tax preparation process.

### Cryptocurrency Gains and Losses

When reporting their taxes, investors must differentiate between capital gains and losses. If a cryptocurrency is sold for more than its purchase price, the investor experiences a capital gain, which is subject to taxation. Conversely, if the sale price is lower than the purchase price, the investor incurs a capital loss, which can potentially offset gains and reduce tax liability. Understanding how to calculate these gains and losses is key to filing accurate tax returns.

### Utilizing Tax Software and Professional Help

Given the complexity of cryptocurrency taxation, many investors may benefit from utilizing tax software specifically designed for crypto transactions. These tools can help automate calculations and ensure compliance with tax laws. Additionally, consulting with a tax professional who is knowledgeable about cryptocurrency can provide valuable guidance and help investors navigate the intricacies of tax regulations.

### Conclusion

In summary, U.S. crypto investors must prepare to file their 2024 tax returns by April 15, 2025, ensuring they report all taxable events, including sales, trades, staking, and airdrops. As the IRS continues to enforce tax compliance within the crypto space, it’s crucial for investors to maintain accurate records and seek assistance when necessary. By taking proactive steps to understand their tax obligations, crypto investors can navigate the complexities of taxation and remain compliant while fully participating in the evolving digital currency landscape.

For more information on cryptocurrency taxation and to stay updated on important deadlines, follow reputable sources such as Cointelegraph and consult with tax professionals specializing in cryptocurrency.

JUST IN: U.S. crypto investors must file their 2024 tax returns by April 15, 2025, reporting all taxable events like sales, trades, staking, and airdrops. pic.twitter.com/JMWrBpXj7P

— Cointelegraph (@Cointelegraph) March 31, 2025

JUST IN: U.S. Crypto Investors Must File Their 2024 Tax Returns by April 15, 2025

If you’re a crypto investor in the United States, it’s crucial to be aware of the upcoming tax obligations that lie ahead. As announced recently, U.S. crypto investors must file their 2024 tax returns by April 15, 2025. This requirement includes reporting all taxable events like sales, trades, staking, and airdrops. Understanding these obligations can save you from potential headaches down the line.

What Does Reporting Taxable Events Mean?

When it comes to crypto, many investors are still trying to figure out what qualifies as a taxable event. In simple terms, any time you engage in a transaction that involves your cryptocurrency, it may trigger a tax liability. This can include selling your crypto for cash, trading one cryptocurrency for another, or even earning tokens through staking. You might even need to report airdrops, where new tokens are distributed to crypto holders.

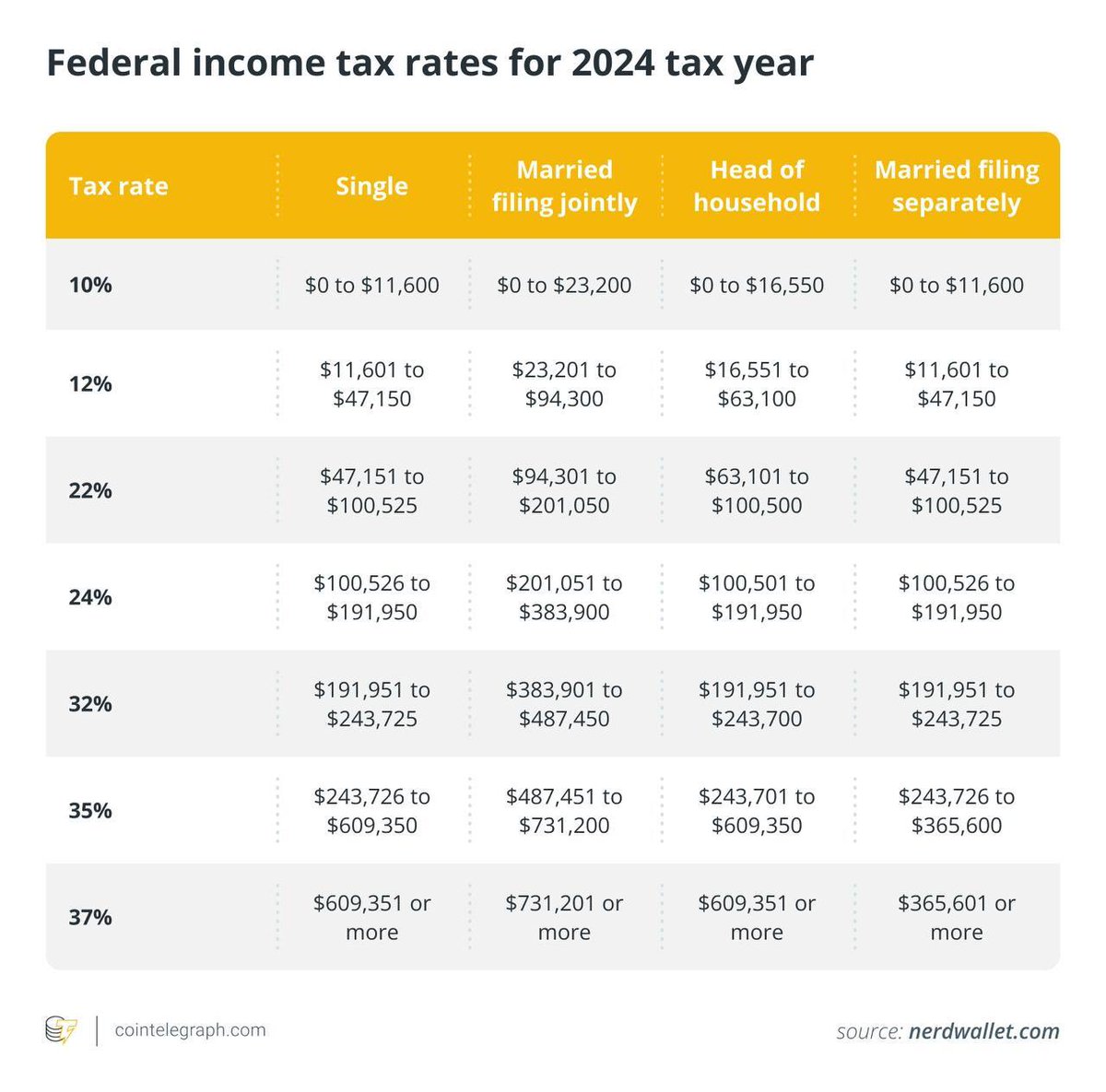

For instance, if you sold Bitcoin for a profit, you’ll need to report that on your tax return. The IRS treats cryptocurrencies as property, meaning that capital gains tax will apply. So, it’s essential to keep meticulous records of when you bought your crypto, the price, and when you sold or traded it.

Why You Should Keep Detailed Records

Keeping detailed records may sound tedious, but trust me, it’s worth it. Good record-keeping will not only help you comply with tax laws but also ensure that you’re not overpaying or underpaying your taxes. You should log every transaction, including dates, amounts, and the value of the cryptocurrency at the time of the transaction.

Platforms like [CoinTracker](https://www.cointracker.io) or [Koinly](https://koinly.io) can help you automate some of this record-keeping. These services can provide real-time tracking of your crypto transactions and generate necessary reports for tax filing.

Understanding Staking and Airdrops

Staking and airdrops are relatively new concepts for many investors. Staking is the process of participating in a network by holding and locking up your cryptocurrency to support blockchain operations, like validating transactions. In return, you earn rewards, often in the form of new tokens.

Airdrops, on the other hand, are typically free distributions of tokens to existing holders of a cryptocurrency. While these activities can be profitable, they also come with tax implications. Staking rewards and airdrops are generally considered income, and you’ll need to report them as such during tax season.

What Happens If You Don’t Report?

Failing to report taxable events can lead to significant repercussions. The IRS is increasingly focusing on cryptocurrency transactions, and they have been known to impose penalties for non-compliance. These could include fines and interest on unpaid taxes. In some cases, failing to report can even trigger an audit. It’s simply not worth the risk.

If you’re unsure about your tax situation, consider consulting a tax professional who specializes in cryptocurrency. They can help you navigate the complexities and ensure you’re fully compliant with tax laws.

Preparing for 2024 Tax Filing

As we approach the tax season for 2024, it’s a good idea to start preparing now. Gather all necessary documents and ensure your records are organized. Make a habit of tracking your transactions regularly instead of scrambling to find everything at the last minute.

You might want to create a spreadsheet that includes details of all your transactions, including sales, trades, staking rewards, and airdrops. This will make it easier to calculate your gains and losses when it’s time to file your taxes.

Using Tax Software for Easier Filing

With technology at our fingertips, there are numerous tax software options available that can simplify the filing process. Many of these programs can import your transaction history directly from major crypto exchanges, making calculations much easier. Some popular tax software options include [TurboTax](https://turbotax.intuit.com) and [H&R Block](https://www.hrblock.com).

These platforms are designed to help you navigate the complexities of crypto tax laws and ensure that you’re filing accurately. Leveraging these tools can save you a lot of time and effort.

Stay Updated with Tax Regulations

Crypto regulations are constantly evolving, so it’s crucial to stay informed about changes that may affect your tax obligations. The IRS frequently updates its guidelines regarding cryptocurrencies, and recent announcements indicate that they are tightening their grip on enforcement.

To stay updated, follow reliable sources like [Cointelegraph](https://cointelegraph.com) or [Decrypt](https://decrypt.co). These platforms often provide timely updates on tax regulations and best practices for crypto investors.

Conclusion

As a crypto investor, being proactive about your tax obligations is key to avoiding potential pitfalls. Remember, U.S. crypto investors must file their 2024 tax returns by April 15, 2025, reporting all taxable events like sales, trades, staking, and airdrops. By keeping detailed records, understanding the nuances of taxable events, and utilizing available resources, you can navigate this complex landscape with confidence.