Trump’s World Liberty Financial Launches 100% Backed USD1 Stablecoin with Treasuries & Cash Equivalents

.

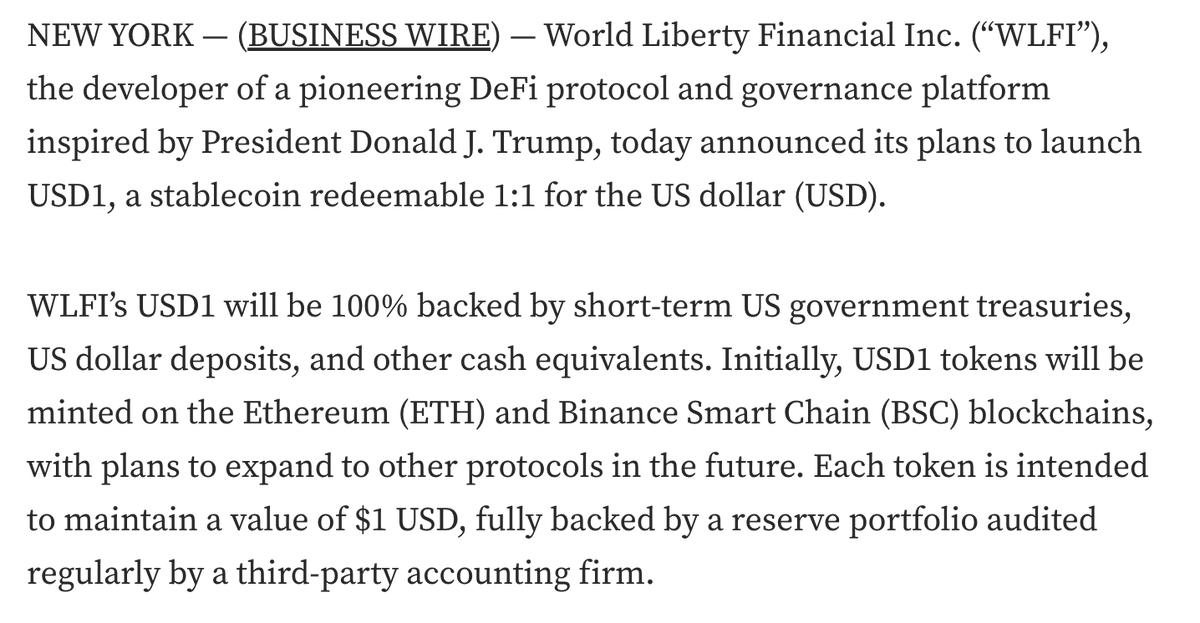

BREAKING: President Trump's World Liberty Financial announces USD1 stablecoin which is "100% backed by short-term US government treasuries, US dollar deposits, and other cash equivalents."

—————–

President Trump’s World Liberty Financial Launches USD1 Stablecoin

In a significant development in the cryptocurrency space, President Trump’s World Liberty Financial has announced the launch of a new stablecoin, the USD1. This digital currency is designed to provide stability and confidence for investors, as it is "100% backed by short-term US government treasuries, US dollar deposits, and other cash equivalents." This initiative is poised to capture the attention of both seasoned investors and newcomers to the crypto market.

What is a Stablecoin?

Stablecoins are a type of cryptocurrency that aim to maintain a stable value relative to a fiat currency or a basket of assets. They are designed to reduce the volatility typically associated with cryptocurrencies like Bitcoin and Ethereum. The USD1 stablecoin, backed by reliable assets, promises to offer a secure and stable option for users looking to engage in digital transactions without the fear of drastic price fluctuations.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE.

Backing and Security

The USD1 stablecoin is uniquely positioned in the market due to its backing by short-term US government treasuries and US dollar deposits. This backing ensures that each USD1 token has a tangible value, providing a layer of security that many investors seek in the volatile world of cryptocurrencies. By linking the stablecoin to government-backed assets, World Liberty Financial aims to foster trust among users, making it an attractive option for both individuals and businesses.

Implications for the Cryptocurrency Market

The introduction of the USD1 stablecoin by World Liberty Financial could have far-reaching implications for the cryptocurrency market. As more institutional and mainstream investors look for safer entry points into the digital currency ecosystem, stablecoins like USD1 could play a crucial role in bridging the gap between traditional finance and the digital economy. Investors may find the USD1 stablecoin appealing, particularly those who have been hesitant to invest in more volatile cryptocurrencies due to concerns about price swings.

Market Reactions

The announcement has already sparked discussions within the cryptocurrency community and financial sectors. Early reactions indicate a cautiously optimistic sentiment, with many experts highlighting the potential for increased adoption of stablecoins as a means of transaction and investment. The backing of a stable asset class could encourage more businesses to accept cryptocurrency payments, potentially leading to broader acceptance of digital currencies in everyday transactions.

Future Prospects

As the landscape of digital currencies evolves, the launch of the USD1 stablecoin may pave the way for further innovations in the stablecoin segment. With regulatory scrutiny on the rise, the commitment to backing the stablecoin with secure assets could serve as a model for future stablecoin projects. Investors will be watching closely to see how World Liberty Financial executes its vision and whether the USD1 stablecoin can gain traction in a competitive market.

Conclusion

The launch of President Trump’s USD1 stablecoin marks a pivotal moment in the cryptocurrency world, combining the advantages of digital currencies with the security of traditional finance. As it strives to establish itself in the market, the USD1 stablecoin could redefine how individuals and businesses perceive and utilize digital currencies. The backing by US government treasuries and cash equivalents not only enhances its appeal but also sets a precedent for future developments in the cryptocurrency ecosystem.

BREAKING: President Trump’s World Liberty Financial announces USD1 stablecoin which is “100% backed by short-term US government treasuries, US dollar deposits, and other cash equivalents.” pic.twitter.com/ckBJDiPdyn

— The Kobeissi Letter (@KobeissiLetter) March 25, 2025

BREAKING: President Trump’s World Liberty Financial Announces USD1 Stablecoin

In an exciting development for the cryptocurrency world, President Trump’s World Liberty Financial has launched a USD1 stablecoin. This new digital currency has garnered attention for its unique backing—it’s “100% backed by short-term US government treasuries, US dollar deposits, and other cash equivalents.” This announcement, shared via Twitter by The Kobeissi Letter, signals a significant step in the intersection of government finance and cryptocurrency.

Understanding Stablecoins and Their Importance

Stablecoins have emerged as a vital component in the cryptocurrency landscape. They are designed to provide price stability by pegging their value to a reserve of assets. In this case, the USD1 stablecoin aims to provide a secure and reliable digital currency option for users. Backed by short-term US government treasuries and cash equivalents, this stablecoin offers a level of trust and reliability that many cryptocurrencies lack.

For those unfamiliar, the primary allure of stablecoins lies in their ability to maintain a stable value, making them ideal for transactions and as a store of value. Unlike traditional cryptocurrencies like Bitcoin and Ethereum, which can be extremely volatile, stablecoins aim to provide a more stable alternative. This makes them particularly appealing for investors and businesses looking to enter the crypto space without the risks associated with significant price fluctuations.

The Backing of the USD1 Stablecoin

The backing of the USD1 stablecoin is particularly noteworthy. By being “100% backed” by short-term US government treasuries, US dollar deposits, and other cash equivalents, the stablecoin aligns itself closely with traditional finance. This backing instills a sense of security for users, as they can trust that their digital assets are supported by stable, government-backed resources.

Short-term government treasuries are considered one of the safest investments available. By integrating these into the backing of the USD1 stablecoin, World Liberty Financial is providing users with a token that has a direct correlation to the stability of the US economy. For users, this means they can engage in transactions with a digital currency that holds real-world value.

The Impact on the Cryptocurrency Market

The launch of the USD1 stablecoin may have ripple effects throughout the cryptocurrency market. For one, it could encourage more conservative investors to dip their toes into the digital currency waters. The assurance that their investments are backed by tangible assets may attract those who have been hesitant to engage with cryptocurrencies due to their notorious volatility.

Furthermore, the announcement may also lead to increased competition among existing stablecoins. Other players in the market, such as Tether (USDT) and USD Coin (USDC), may feel the pressure to enhance their offerings to maintain their user base. This could result in improvements in transparency, security, and overall user experience across the board.

What This Means for Your Investments

If you’re considering investing in cryptocurrency, the introduction of the USD1 stablecoin could be a game changer. Its backing by solid financial instruments provides a layer of security that many investors are looking for. Additionally, the stablecoin could serve as a gateway for individuals and businesses that are new to the crypto space, allowing them to transition into digital currency without taking on excessive risk.

Moreover, businesses that accept cryptocurrencies may find it easier to integrate a stablecoin like USD1 into their payment systems. The stability of the coin could simplify accounting processes and provide a more straightforward means of transaction than dealing with more volatile currencies.

The Future of World Liberty Financial and USD1 Stablecoin

Looking ahead, the future of World Liberty Financial and the USD1 stablecoin seems promising. As more people become aware of the benefits of stablecoins, World Liberty Financial could see an influx of users looking for a reliable digital currency. The backing of short-term US government treasuries adds a layer of legitimacy that could set it apart from other cryptocurrencies.

Moreover, as the regulatory landscape for cryptocurrencies continues to evolve, having a stablecoin with robust backing may put World Liberty Financial in a favorable position. Regulatory bodies are becoming increasingly interested in how cryptocurrencies are structured and backed, and this stablecoin’s design may align well with emerging regulations.

Conclusion

The announcement of President Trump’s World Liberty Financial USD1 stablecoin is a significant milestone in the world of digital currency. With its backing by short-term US government treasuries and cash equivalents, it offers a level of security and stability that many investors will appreciate. As the cryptocurrency market continues to evolve, this stablecoin could play a pivotal role in bridging the gap between traditional finance and the innovative world of digital currency.

For those interested in the cryptocurrency space, the USD1 stablecoin presents an opportunity to engage with a more stable digital asset. Keep an eye on how this development unfolds, as it may influence investment strategies and the overall dynamics of the cryptocurrency market.