World Liberty Financial’s Bold $3M Purchase: Is There a Hidden Strategy Behind Their $109M Loss?

.

Breaking:

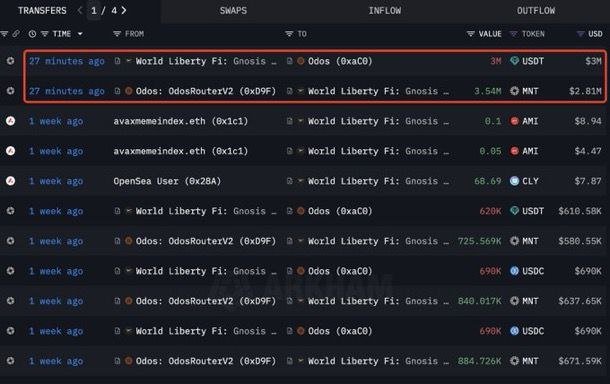

World Liberty Financial has bought 3.54 million $MNT for $3 million.

As of now, World Liberty Financial has a total loss of $109 million but they're buying continuously.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. : Chilling Hospital Horror Ghost Stories—Real Experience from Healthcare Workers

Do they know something?

—————–

World Liberty Financial’s Bold Move Amid Losses

In a surprising development, World Liberty Financial has acquired a staggering 3.54 million shares of the cryptocurrency $MNT for a total investment of $3 million. This strategic purchase raises eyebrows, especially considering that the company is currently facing a cumulative loss of $109 million. The decision to continue investing heavily in $MNT, despite these losses, prompts questions about the company’s future outlook and their potential insight into the cryptocurrency market.

Understanding the Investment

World Liberty Financial’s recent acquisition of $MNT appears to be a calculated risk. With a significant investment of $3 million, the company is signaling its confidence in the long-term value of $MNT. This cryptocurrency has garnered attention for its volatility and potential for high returns, making it a focal point for investors looking to capitalize on the burgeoning digital currency market.

The Implications of Losses

Despite the current losses, World Liberty Financial’s ongoing purchases suggest they might be banking on a turnaround in the value of $MNT. The company’s willingness to invest further raises the question: do they possess insider knowledge or insights into the cryptocurrency landscape that the average investor does not? Such a bold move could indicate that they are anticipating a significant recovery or growth in the value of $MNT in the near future.

Market Reactions

The news of World Liberty Financial’s investment has sparked discussions across social media platforms, particularly on Twitter. Investors and analysts are closely monitoring the situation, speculating on the reasons behind such a substantial acquisition amidst losses. This development could be a turning point for $MNT and might attract more investors looking for opportunities in a fluctuating market.

Strategic Considerations

Investing in cryptocurrencies like $MNT can be a double-edged sword. On one hand, the potential for high returns is enticing; on the other, the risks associated with market volatility can lead to significant losses. World Liberty Financial’s strategy could be seen as either a calculated gamble or a display of confidence in the cryptocurrency’s future. As they continue to buy into $MNT, stakeholders are likely to scrutinize their next moves closely.

Conclusion

World Liberty Financial’s recent acquisition of 3.54 million shares of $MNT for $3 million has raised eyebrows in the investment community. The company’s ongoing commitment to purchasing despite facing a $109 million loss suggests that they may be anticipating a positive shift in the cryptocurrency market. As the situation unfolds, investors and analysts will be keenly watching World Liberty Financial’s strategy and the performance of $MNT. Whether this move will pay off remains to be seen, but it certainly positions the company as a significant player in the evolving cryptocurrency landscape.

For more updates and insights on cryptocurrency investments and financial strategies, stay tuned to our channel.

Breaking:

World Liberty Financial has bought 3.54 million $MNT for $3 million.

As of now, World Liberty Financial has a total loss of $109 million but they’re buying continuously.

Do they know something? pic.twitter.com/ClTdj7mQzL

— Cas Abbé (@cas_abbe) March 24, 2025

Breaking: World Liberty Financial Has Bought 3.54 Million $MNT for $3 Million

Have you heard the latest buzz in the financial world? World Liberty Financial has just made headlines by purchasing a staggering 3.54 million shares of $MNT for a cool $3 million. This bold move is certainly raising eyebrows across the industry, especially considering the current financial landscape. With World Liberty Financial already facing a total loss of $109 million, one can’t help but wonder what they know that the rest of us don’t.

When a company takes such a significant step, it’s not just about the numbers on a balance sheet. It’s about strategy, foresight, and perhaps even a bit of insider knowledge. So, what’s really going on here? Are they betting on a turnaround, or is there a hidden gem within the $MNT stock that they believe will shine brightly in the future?

As of Now, World Liberty Financial Has a Total Loss of $109 Million But They’re Buying Continuously

The fact that World Liberty Financial is continuing to buy shares despite a hefty loss of $109 million is intriguing. Most investors might be hesitant to throw good money after bad, but World Liberty seems to be doubling down. This raises a lot of questions about their investment strategy and what they see in $MNT.

Investors often look for signs of recovery or growth potential before making further investments, so it’s safe to say there must be some serious analysis happening behind the scenes. Perhaps they are banking on upcoming developments in the $MNT company that could turn the tide.

Their willingness to invest further while accumulating losses suggests a level of confidence that many might not share. This could indicate a strong belief in the fundamentals of the company or maybe an expectation of positive news on the horizon.

Curious minds might want to dig deeper into what makes $MNT so compelling. Is there a new product rollout? Are there changes in management or strategy that could signal a shift in performance? The financial world is often driven by speculation, and World Liberty Financial’s actions could be the tip of the iceberg.

Do They Know Something?

With this recent acquisition, the big question remains: do they know something? In finance, the whispers of the market can sometimes be more telling than the official reports. It’s not uncommon for savvy investors to pick up on trends before they become apparent to the masses.

If World Liberty Financial is buying aggressively while already in the red, they might have insights that suggest a forthcoming recovery. This could be anything from new partnerships to market expansion that hasn’t yet been made public.

Investors should always be cautious when following the lead of larger firms, but it’s hard to ignore the potential implications of this purchase. Could World Liberty Financial be positioning themselves for a significant turnaround that others are missing?

For those interested in the intricacies of stock trading, this situation serves as a reminder of the complexities involved in investment decisions. Sometimes, it’s not just about the current financials but understanding the broader context and potential future developments.

The Bigger Picture of $MNT

So, what does this mean for $MNT as a stock? Well, it’s a mixed bag. On one hand, the current losses might deter some investors from jumping in. On the other hand, World Liberty Financial’s substantial purchase could signal a wave of confidence.

Potential investors should take a closer look at $MNT—what’s the company’s current performance? Are there upcoming announcements that could influence the stock price? In the world of finance, timing can be everything, and understanding the current climate is crucial.

Furthermore, it could also be beneficial to keep an eye on the financial news related to $MNT. Market analysts often provide insights that can help in making informed decisions. If World Liberty Financial sees potential, maybe it’s time for others to take a second look as well.

What Can We Learn from This Situation?

There’s a lot to unpack when it comes to World Liberty Financial’s latest move. It highlights the need for investors to stay informed and to consider both current performance and future possibilities. The financial landscape is often unpredictable, and sometimes those who take risks end up reaping the rewards.

While following the actions of larger firms can be part of a sound investment strategy, it’s essential to conduct thorough research and analysis. Understanding the nuances of a stock like $MNT can empower investors to make informed decisions.

In conclusion, World Liberty Financial’s recent purchase of $MNT shares may be a sign of deeper insights into the company that the public isn’t yet privy to. Whether this will lead to a significant turnaround for both the company and the investors remains to be seen. But one thing is clear: staying alert to changes and trends in the market can pave the way for future successes.

So, what are your thoughts? Is it time to take a closer look at $MNT, or do you think World Liberty Financial is taking a gamble? Whatever your opinion, the financial world is always full of surprises.