Trump Insider Whale Targets $380M Bitcoin Short! Hunted Publicly at $86,600 – What’s Going On?

.

WOW!!! THIS IS CRAZYYY

Trump insider whale who opened a

$380 million bitcoin short with 40x

is being hunted publicly on “ X ” by

a group of people who are trying to

liquidate him at $86,600.

—————–

Bitcoin Shorting Controversy: Insider Whale Targeted

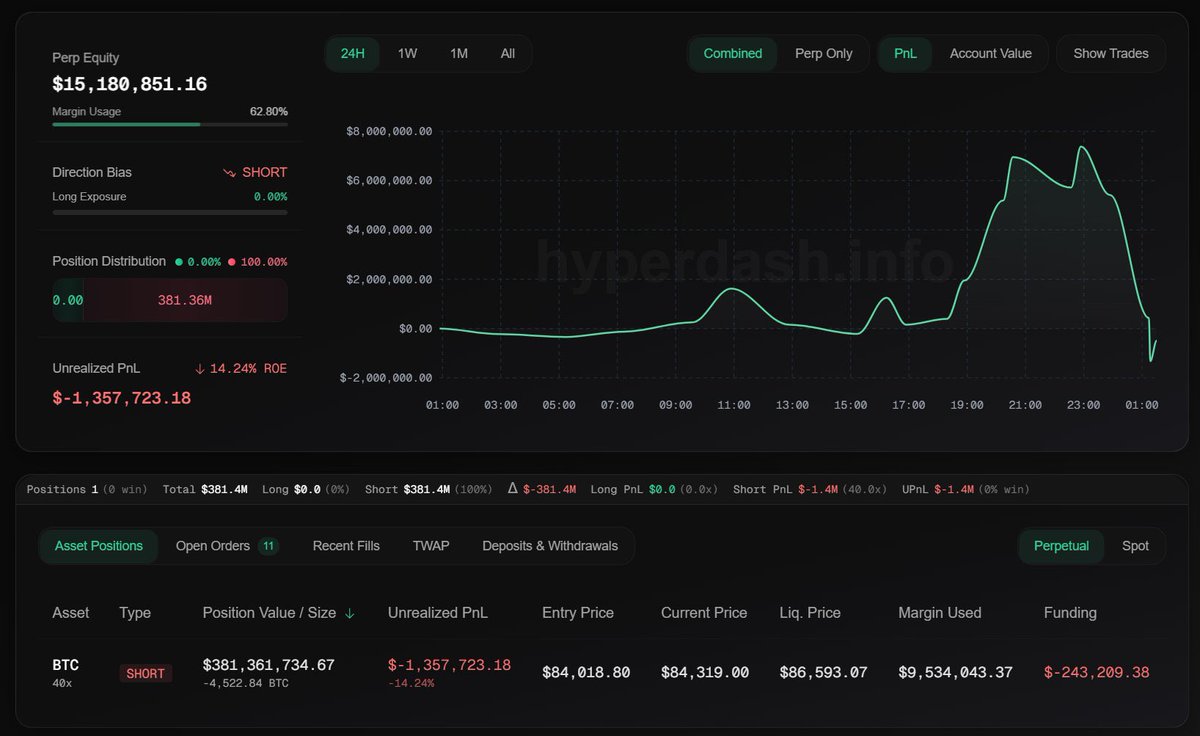

In a surprising turn of events within the cryptocurrency space, a Trump insider, referred to as a "whale," has made headlines by opening a staggering $380 million Bitcoin short position with a leverage of 40x. This aggressive trading move has drawn the attention of the crypto community and prompted a public hunt for the individual on the social media platform X (formerly known as Twitter). The circumstances surrounding this high-stakes maneuver are raising eyebrows, as traders aim to liquidate the whale’s position at a price point of $86,600.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE.

The Context of the $380 Million Bitcoin Short

Shorting Bitcoin has become a controversial topic, especially when the stakes are as high as $380 million. This insider’s decision to leverage such a significant amount amplifies the risks involved, particularly given the volatile nature of the cryptocurrency market. By using a 40x leverage, the whale is betting that Bitcoin’s price will decline. However, if the price moves against this position, the consequences could be catastrophic, leading to substantial losses.

The Community Reaction and Public Hunt

The crypto community’s reaction has been nothing short of explosive. As details of the whale’s position spread across social media, a dedicated group of traders has taken it upon themselves to track and potentially liquidate the insider’s position. The target price of $86,600 signifies a critical threshold where the whale’s short position could be in jeopardy, prompting the community’s active involvement.

This public hunt highlights the competitive and often ruthless nature of trading in the cryptocurrency market. Traders are not only focused on their own positions but are also keenly aware of the larger market dynamics, including the activities of influential players like this insider whale.

Implications for the Bitcoin Market

The implications of this situation are profound. As more traders become aware of the whale’s position, it could lead to increased volatility in the Bitcoin market. The potential liquidation of such a large short position could create a ripple effect, influencing Bitcoin’s price and potentially triggering a short squeeze. This phenomenon occurs when the price of an asset rises sharply, forcing short sellers to buy back their positions to cover losses, which in turn drives the price even higher.

Conclusion

In conclusion, the $380 million Bitcoin short opened by a Trump insider whale has set off a chain reaction within the cryptocurrency community. With a leverage of 40x, the risks are immense, and the public hunt for this whale adds another layer of intrigue to the situation. As the market watches closely, the developments surrounding this case will likely have significant ramifications for Bitcoin’s price and the broader cryptocurrency landscape. Traders and enthusiasts alike are keen to see how this dramatic narrative unfolds, emphasizing the unpredictable and often thrilling nature of cryptocurrency trading.

In a world where information spreads rapidly, this incident serves as a reminder of the power dynamics at play in the crypto market, where large players can significantly influence market trends and sentiments.

WOW!!! THIS IS CRAZYYY

Trump insider whale who opened a

$380 million bitcoin short with 40x

is being hunted publicly on “ X ” by

a group of people who are trying to

liquidate him at $86,600. pic.twitter.com/3z6ZGVtXFz— Ash Crypto (@Ashcryptoreal) March 16, 2025

WOW!!! THIS IS CRAZYYY

Have you heard the latest buzz in the crypto world? It’s absolutely wild! A Trump insider whale has just made headlines by opening a massive $380 million bitcoin short with a staggering 40x leverage. And now, this individual is being hunted publicly on “X” (formerly Twitter) by a group of traders who are trying to liquidate him at an eye-popping price of $86,600. If that doesn’t get your adrenaline pumping, I don’t know what will!

Trump Insider Whale: Who Is He?

So, let’s unpack this whole situation. The term “whale” in the cryptocurrency world refers to someone who holds a massive amount of cryptocurrency. In this case, the Trump insider whale is not just a random trader; he’s someone who seems to have inside knowledge of market dynamics. This situation raises a lot of eyebrows and questions about how much impact one individual can have on the market.

In a world where every move can lead to significant financial gains or losses, this whale’s decision to go short on bitcoin is particularly bold. A $380 million short position is not something you see every day, especially with a 40x leverage. It’s like betting the farm on a single outcome, which is both risky and intriguing.

The Mechanics of a Bitcoin Short Position

For those who might be scratching their heads, let’s break down what a short position means. When someone takes a short position, they are essentially betting that the price of an asset, in this case, bitcoin, will fall. If they’re right, they make a profit; if not, they face potentially unlimited losses. With a leverage of 40x, the stakes are even higher. This means that for every dollar he puts down, he’s controlling $40 worth of bitcoin. It’s a double-edged sword that can lead to massive profits or catastrophic losses.

Public Hunt for Liquidation

Now, here’s where it gets even more interesting. A group of individuals has taken it upon themselves to publicly hunt this whale, aiming to liquidate his position at $86,600. Liquidation happens when the price of the asset moves against the position’s expectations, causing the broker to close the position to prevent further losses. In this case, if bitcoin reaches $86,600, the whale would be liquidated, meaning he’d lose a significant chunk of his investment.

This public hunt adds an entertaining layer to the whole scenario. It’s a real-life game of cat and mouse where traders are actively trying to track the whale’s moves. Social media platforms like “X” have become battlegrounds where traders share strategies, insights, and updates. It’s like watching a live-action thriller unfold right before our eyes!

The Implications of Such Moves

What does this mean for the crypto market? Well, it certainly adds a level of volatility. The ripple effects of a whale’s actions can be felt throughout the market. If this insider whale’s position gets liquidated, it could potentially drive the price of bitcoin down even further, creating a snowball effect. On the flip side, if the price rebounds and the whale manages to pull off a miracle, we might see a surge in bitcoin’s value.

The drama surrounding this whale is a reminder of how unpredictable and thrilling the cryptocurrency landscape can be. Traders are keeping a close eye on the price movements, and social media is buzzing with predictions and analyses. This is not just trading; it’s a spectacle!

Engaging with the Community

If you’re interested in following this saga, engaging with the crypto community on platforms like “X” can be quite enlightening. You’ll find a mix of seasoned traders and newcomers alike, all trying to make sense of the chaos. Just remember, trading cryptocurrencies carries risks, and it’s essential to do your research before diving in.

What Lies Ahead for Bitcoin?

As the story unfolds, many are left wondering what lies ahead for bitcoin. Will the whale manage to outsmart the crowd, or will the collective efforts of the hunters succeed? The crypto world thrives on these kinds of high-stakes scenarios, keeping everyone on their toes.

In the end, the tale of the Trump insider whale is more than just a story of financial maneuvering; it’s a reflection of the intense dynamics within the cryptocurrency market. It showcases how quickly fortunes can change and how one individual’s decisions can ripple through the entire ecosystem.

Stay Informed and Engaged

Whether you’re a seasoned trader or a curious observer, staying informed about developments like these is crucial. Make sure to follow credible sources for updates, and don’t hesitate to join conversations online. The crypto community is vibrant, and there’s always something new to learn. As this situation continues to evolve, it promises to deliver more surprises and lessons for everyone involved.

“`