Breaking: $332M Bitcoin Short with 40x Leverage Sparks Potential Short Squeeze!

.

BREAKING:

SOMEONE HAS OPENED A BITCOIN

SHORT WITH $332 MILLION, WITH

40X LEVERAGE HIS LIQUIDATION IS

AT $85,300.

SHORT SQUEEZE INCOMING

—————–

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE.

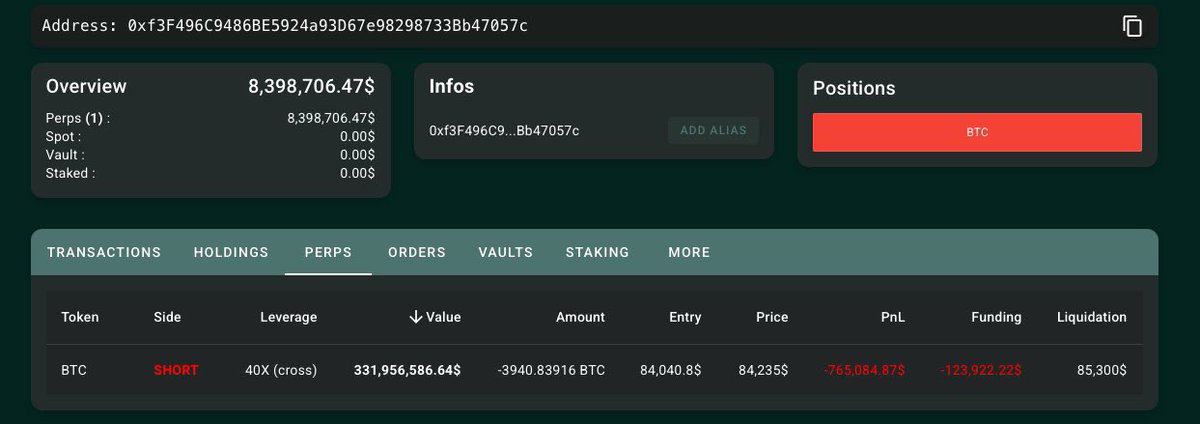

In a dramatic turn of events in the cryptocurrency market, a significant Bitcoin short position has been opened with a staggering $332 million at 40x leverage. This move, announced via Twitter by crypto influencer Ash Crypto, has raised eyebrows across the trading community. With such high leverage, the liquidation price is set at $85,300. The implication of this move is the potential for a short squeeze, which could have far-reaching effects on the Bitcoin market.

### The Mechanics of High-Leverage Trading

Trading with high leverage, such as 40x, amplifies both potential profits and losses. In this case, if Bitcoin’s price were to surge past the liquidation threshold of $85,300, the trader would face significant losses, potentially triggering a wave of selling. This scenario could lead to a short squeeze, where short sellers are forced to buy back their positions to cover losses, driving the price higher. Such market dynamics often create volatility, attracting traders looking to capitalize on rapid price movements.

### Short Squeeze Potential

The concept of a short squeeze is critical in understanding the implications of this massive short position. As the market reacts to the potential for a squeeze, bullish sentiment may begin to grow, leading to a surge in Bitcoin’s price. This reaction could be exacerbated by retail investors who, seeing the potential for rapid gains, may enter the market, further driving prices up. The combination of forced buying from short sellers and new bullish investors can create a rapid upward price spiral.

### Market Reactions and Sentiment

The cryptocurrency market is notoriously volatile, and news of such significant trades can send ripples through the community. Traders and investors alike will be closely monitoring the situation as it unfolds. Social media platforms, particularly Twitter, have become hotbeds for discussions and speculation surrounding this trade. The community is buzzing with predictions about how this short position could influence Bitcoin’s price in the short term. Many believe that the risk of a short squeeze may prompt a bullish rally, while others express caution, citing the inherent risks of high-leverage trading.

### The Future of Bitcoin Pricing

As Bitcoin continues to be a focal point of investment and speculation, events like this highlight the ongoing tension between bullish and bearish sentiments in the market. The short position opened with $332 million underscores the high stakes involved in cryptocurrency trading today. Traders must navigate a landscape filled with potential rewards but also significant risks.

### Conclusion: Watching the Market

In conclusion, the opening of a $332 million Bitcoin short position at 40x leverage signals a pivotal moment in the cryptocurrency market. As traders brace for a potential short squeeze, all eyes are on Bitcoin’s price movements. Investors need to stay informed and be prepared for rapid shifts in market sentiment. The coming days will be crucial in determining whether this high-stakes trade leads to a bullish rally or if it signals a more bearish trend in the cryptocurrency landscape.

Stay connected with the latest developments in the cryptocurrency market to better understand the implications of such significant trades and to make informed investment decisions.

BREAKING:

SOMEONE HAS OPENED A BITCOIN

SHORT WITH $332 MILLION, WITH

40X LEVERAGE HIS LIQUIDATION IS

AT $85,300.SHORT SQUEEZE INCOMING pic.twitter.com/wSmR8791Qt

— Ash Crypto (@Ashcryptoreal) March 16, 2025

BREAKING: SOMEONE HAS OPENED A BITCOIN SHORT WITH $332 MILLION, WITH 40X LEVERAGE HIS LIQUIDATION IS AT $85,300.

In the world of cryptocurrency, news travels fast, and when a major move happens, it can send shockwaves through the entire market. Recently, a tweet by Ash Crypto caught everyone’s attention, announcing that a trader has opened a massive Bitcoin short position worth a staggering $332 million, utilizing an aggressive 40x leverage. This bold move means that if Bitcoin’s price reaches $85,300, this trader will face liquidation. The implications of such a significant short position could lead to a short squeeze, which many are already speculating about. So, what does this mean for Bitcoin and the broader crypto market?

Understanding the Mechanics of Bitcoin Shorts

To fully grasp the impact of this short position, it’s essential to understand what “shorting” Bitcoin entails. When a trader shorts Bitcoin, they are essentially betting that the price of Bitcoin will fall. By using leverage, they can amplify their potential profits, but this also increases their risk. In this case, with a 40x leverage, the trader is effectively controlling a position much larger than their initial capital, which can lead to massive gains or devastating losses.

For this trader, the liquidation price is a critical number. If Bitcoin’s price rises above $85,300, the exchange will automatically close their position to prevent further losses. This is known as a margin call and can lead to a cascading effect in the market, where other traders also get liquidated, leading to a sharp price increase in what is known as a short squeeze.

What is a Short Squeeze and Why Does it Matter?

A short squeeze occurs when a heavily shorted asset, like Bitcoin in this case, experiences a sudden price increase. This forces short sellers to buy back their positions to limit their losses, further driving up the price. The anticipation of a short squeeze can create a frenzy among traders, as they look to capitalize on the potential price movement. The tweet from Ash Crypto suggests that this could be on the horizon, which has sparked interest and excitement in the community.

The Current State of Bitcoin

Bitcoin has been known for its volatility, and recent trends indicate that it is no exception. The cryptocurrency market is influenced by various factors, including regulatory news, technological advancements, and market sentiment. As of now, many traders and investors are closely monitoring Bitcoin’s price movements, especially in light of this new short position.

In the past, Bitcoin has reached significant highs, and while it has faced corrections, it has also rebounded strongly. The current price action could be pivotal for both those holding long positions and those betting against Bitcoin. Given the substantial short position at stake, it’s likely that many eyes will be on Bitcoin as it approaches key price levels.

Strategies for Traders in Light of Recent Developments

If you’re a trader, the news of a $332 million Bitcoin short position might make you reconsider your strategy. Here are a few tips to navigate this environment:

- Stay Informed: Keep an eye on price movements and market sentiment. Follow updates from credible sources to understand how the situation evolves.

- Consider Your Risk Tolerance: Trading with leverage can amplify gains but also losses. Ensure that you are comfortable with the level of risk you are taking on.

- Diversify Your Portfolio: While Bitcoin is a leading cryptocurrency, diversifying your investments can help mitigate risks associated with sudden market shifts.

- Use Stop-Loss Orders: Protect yourself from significant losses by setting stop-loss orders, especially in a volatile market like cryptocurrency.

Market Reactions and Predictions

The crypto community is buzzing with predictions about how this massive short position will play out. Some analysts believe that a short squeeze is imminent, which could lead to a rapid price increase for Bitcoin. Others caution that the market is unpredictable, and traders should be prepared for any outcome.

As the situation unfolds, many are also discussing the implications for the broader market. Will this lead to increased volatility in Bitcoin and other cryptocurrencies? Or will it stabilize the market by shaking out weak hands? Only time will tell, but one thing is for sure—this situation is worth watching closely.

Conclusion: What’s Next for Bitcoin?

The announcement of a $332 million Bitcoin short with 40x leverage has certainly stirred the pot in the cryptocurrency world. As traders and investors wait to see how the market responds, it’s crucial to approach this information with a strategic mindset. The potential for a short squeeze could lead to significant price movements, and understanding the dynamics at play will be essential for anyone looking to navigate this landscape successfully.

As always, stay informed, tread carefully, and remember that the crypto market can be a wild ride. Whether you’re a seasoned trader or just starting, make sure you keep your eyes on the price and your strategy flexible. The world of Bitcoin is full of opportunities, but it’s also full of risks!