BREAKING: Eric Trump Announces Zero Capital Gains Tax for U.S. Crypto Projects! XRP Rises!

.

BREAKING: ERIC TRUMP CONFIRMS U.S.-BASED CRYPTO PROJECTS WILL BENEFIT FROM ZERO CAPITAL GAIN TAX! #XRP IS THE CHOSEN ONE! https://t.co/vGrvCICqRz

—————–

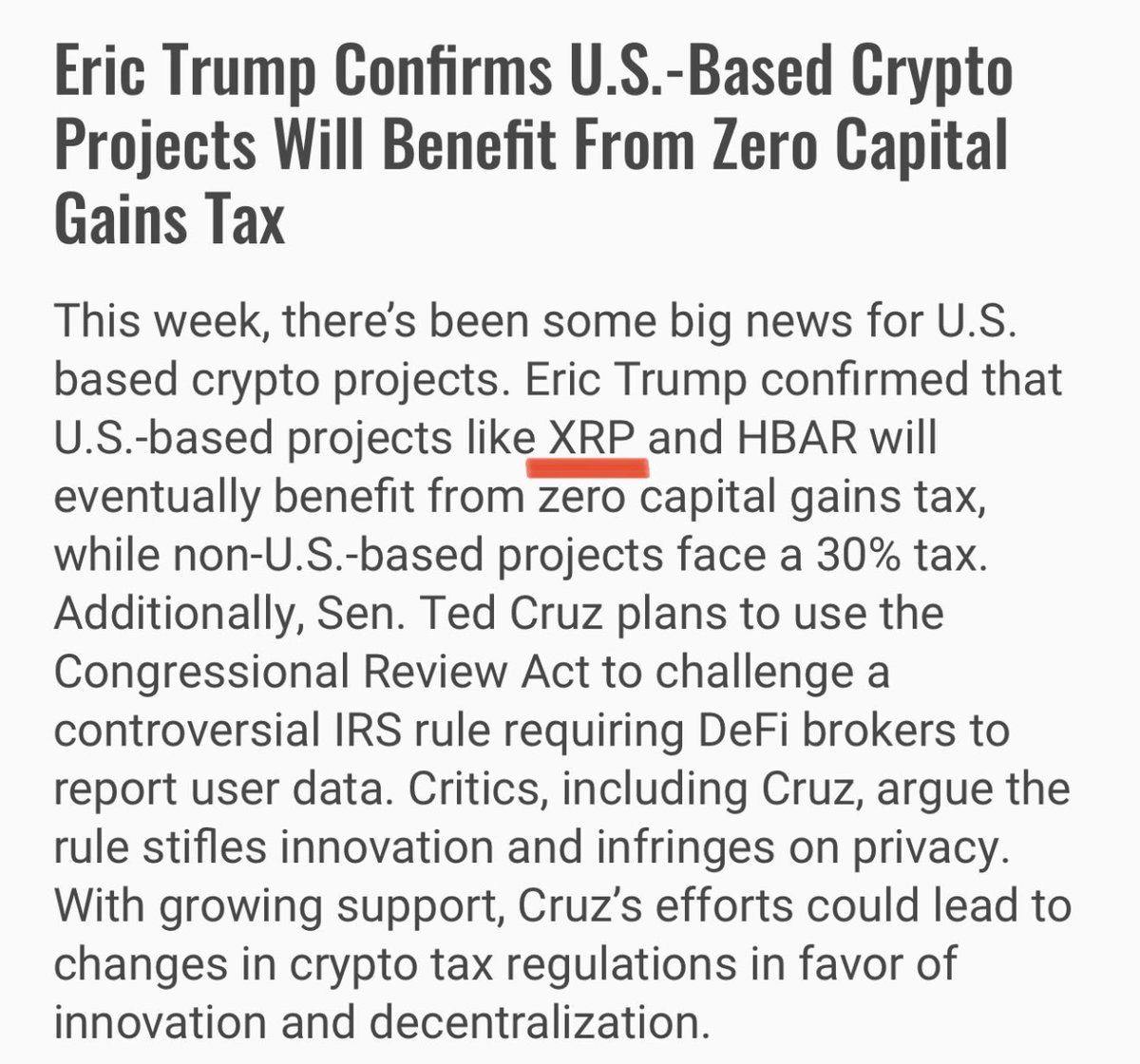

On January 24, 2025, a significant announcement emerged from Eric Trump regarding the future of cryptocurrency projects based in the United States. According to Trump, these projects are set to benefit from a groundbreaking policy: zero capital gains tax. This development has the potential to reshape the landscape of cryptocurrency investment and innovation in the U.S., making it an attractive destination for crypto entrepreneurs and investors alike.

### U.S.-Based Crypto Projects and Zero Capital Gains Tax

The confirmation of zero capital gains tax on U.S.-based cryptocurrency projects is a game-changer in the financial and technological sectors. This policy aims to stimulate growth within the crypto market, encouraging more individuals and companies to invest in digital assets without the fear of incurring heavy tax penalties. By eliminating capital gains tax, the U.S. government is signaling its intention to become a leader in the global cryptocurrency arena.

### XRP: The Chosen One

In conjunction with this announcement, Eric Trump highlighted XRP as a standout cryptocurrency that will particularly benefit from these favorable tax policies. XRP, known for its rapid transaction speeds and low fees, has long been a favorite among investors and institutions. This endorsement further solidifies XRP’s position in the market, suggesting that it could play a pivotal role in the future of digital finance.

### Implications for Investors

The elimination of capital gains tax is expected to attract a wave of new investors looking to capitalize on the growing cryptocurrency market. With the potential for higher returns and lower tax burdens, both individual and institutional investors may be more inclined to diversify their portfolios with digital assets. This influx of capital could lead to increased liquidity and volatility, which are essential for a healthy and thriving market.

### The Future of Cryptocurrency in the U.S.

As the U.S. embraces this progressive tax policy, the future of cryptocurrency projects looks promising. Companies that have previously hesitated to operate in the U.S. due to regulatory concerns may now find the environment more favorable. This could result in a surge of innovation and technological advancements within the crypto space, as businesses take advantage of the new tax landscape.

### Conclusion

Eric Trump’s confirmation of zero capital gains tax for U.S.-based cryptocurrency projects marks a pivotal moment in the evolution of digital finance. By promoting a more favorable investment climate, the U.S. government is positioning itself as a leader in the global cryptocurrency sector. As XRP emerges as a frontrunner in this landscape, investors and entrepreneurs alike will be closely monitoring the developments that follow. This policy change not only promises to benefit the crypto community but also aims to enhance the overall economic landscape of the United States during a time of rapid technological advancement.

In summary, the announcement represents a significant shift in how cryptocurrency investments will be taxed in the U.S. As more details emerge, both crypto enthusiasts and mainstream investors will be eager to see how this policy will impact the market, especially for prominent cryptocurrencies like XRP. The future looks bright for U.S.-based crypto projects, and the potential for growth is immense.

BREAKING:

ERIC TRUMP CONFIRMS U.S.-BASED CRYPTO PROJECTS WILL BENEFIT FROM ZERO CAPITAL GAIN TAX! #XRP IS THE CHOSEN ONE! pic.twitter.com/vGrvCICqRz

— 𝓐𝓶𝓮𝓵𝓲𝓮 (@_Crypto_Barbie) January 24, 2025

BREAKING:

Eric Trump has just dropped some major news that could shake up the cryptocurrency landscape in the U.S. If you’re involved in crypto or just interested in the financial world, this is definitely something you’ll want to know about. He confirmed that U.S.-based crypto projects will benefit from zero capital gain tax! This is huge for investors and developers alike, as it opens up a world of possibilities for innovation and growth in the crypto sector.

ERIC TRUMP CONFIRMS U.S.-BASED CRYPTO PROJECTS WILL BENEFIT FROM ZERO CAPITAL GAIN TAX!

Imagine the implications of this announcement. By eliminating capital gains tax on U.S.-based crypto projects, Eric Trump has essentially created a more favorable environment for cryptocurrency investment and development. This could lead to an influx of new projects, startups, and innovations that might have otherwise hesitated due to the tax burden. Investors can now feel more secure in their long-term holdings, knowing that they won’t be penalized for their gains when they cash out. This is a game-changer!

#XRP IS THE CHOSEN ONE!

As part of this announcement, many are speculating that XRP may take center stage. With the backing of major policy changes, XRP could solidify its position as a leading cryptocurrency in the U.S. market. If you’re not familiar with XRP, it’s a digital asset designed for fast and low-cost international money transfers. Its utility and efficiency make it a compelling option for those looking to navigate the complexities of cross-border transactions. With zero capital gains tax, it’s likely that more investors will consider XRP as a viable investment.

The Importance of Zero Capital Gain Tax

Why is this zero capital gain tax so significant? For starters, capital gains tax can eat into your profits significantly. For many investors, the prospect of paying taxes on their gains can deter them from investing in the first place. By eliminating this tax for U.S.-based crypto projects, it encourages more people to invest. It creates a more inviting environment for new investors who may have been on the fence about entering the crypto space. With fewer barriers to entry, we could see a surge in the number of participants in the crypto market.

Potential Impact on the Crypto Market

With this announcement, we might see a shift in the overall dynamics of the cryptocurrency market. The removal of capital gains tax could lead to an increase in liquidity, making it easier for people to buy and sell cryptocurrencies without the fear of being taxed. This increased trading volume could potentially elevate prices and create a more vibrant market. It’s an exciting time for crypto enthusiasts, as the landscape is rapidly changing.

What This Means for Investors

For investors, this news is a breath of fresh air. If you’ve been holding on to your cryptocurrencies, the idea of no capital gains tax could mean that your investments are now more valuable than ever. You can make strategic decisions without worrying about the tax implications that once loomed over your profits. This kind of certainty allows for a more strategic approach to investing, where you can focus on the long-term potential of your assets rather than immediate tax consequences.

The Role of Government in Crypto

It’s worth noting that Eric Trump’s confirmation of a zero capital gain tax for U.S.-based crypto projects also highlights a broader trend of potential government support for the cryptocurrency industry. Governments around the world are starting to recognize the value of blockchain technology and digital currencies. By facilitating a more favorable environment for crypto projects, the U.S. could position itself as a leader in the global cryptocurrency market.

Community Reaction

As expected, the reaction from the crypto community has been overwhelmingly positive. Many are seeing this as a validation of the hard work and dedication that has gone into building U.S.-based crypto projects. The announcement has sparked discussions about the future of crypto, and the potential for collaboration between the government and private sector to foster innovation. It’s inspiring to see the community come together in support of this development.

Looking Ahead

With Eric Trump’s confirmation of zero capital gain tax for U.S.-based crypto projects, the future looks bright for the cryptocurrency market. Investors now have a reason to feel more optimistic about their holdings. As more people become aware of this change, we can expect increased interest and investment in cryptocurrencies like XRP. It’s a pivotal moment that could redefine how we view and interact with digital currencies.

Stay Informed

To stay updated on the latest developments in the crypto world, make sure to follow reliable sources and engage with the community. Whether you’re a seasoned investor or just starting out, keeping an eye on policy changes and market trends is crucial. The landscape is evolving rapidly, and being informed will give you an edge as you navigate this exciting journey in the world of cryptocurrency.

In summary, Eric Trump’s announcement could mark a turning point for U.S.-based crypto projects, especially for XRP. With the removal of capital gains tax, the future of cryptocurrency in the U.S. looks promising, opening doors to innovation, investment, and growth.