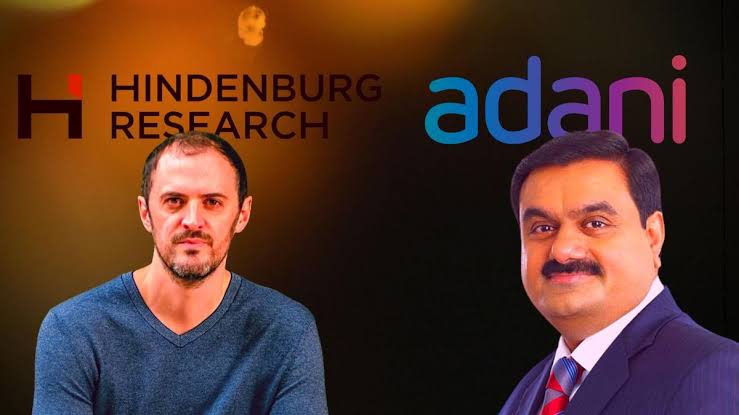

BREAKING: Hindenburg’s Nathan Anderson Faces Securities Fraud Investigations – Shocking Revelations!

.

#BREAKING :

Hindenburg Research, Founder Nathan Anderson named in 'Investigations for Securities Fraud & Faulty Disclosures' as per reports.

“There are multiple counts of securities fraud for both Nate Anderson and Anson Funds, and we have only reviewed 5% of the material https://t.co/iE0CGZJdRJ

—————–

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. : Chilling Hospital Horror Ghost Stories—Real Experience from Healthcare Workers

Hindenburg Research Founder Nathan Anderson Under Investigation for Securities Fraud

In a shocking development that has captured the attention of the financial world, Nathan Anderson, the founder of Hindenburg Research, has been named in an investigation concerning securities fraud and faulty disclosures. A recent tweet from Megh Updates reveals that there are multiple counts of securities fraud linked to Anderson and Anson Funds, with early reports indicating that only a mere 5% of the relevant material has been reviewed thus far. This news raises significant questions about the integrity of financial reporting and the potential consequences for those involved.

Hindenburg Research, known for its critical reports on various companies, gained notoriety for its investigative approach to exposing potential financial malfeasance. The firm has previously released reports that have led to significant declines in stock prices of companies it has scrutinized. However, this latest revelation about its founder raises concerns about potential hypocrisy, given the firm’s self-proclaimed role as a watchdog in the finance sector.

The Implications of the Investigation

The implications of this investigation are profound, not just for Anderson and Hindenburg Research, but also for the broader financial community. Securities fraud can have severe repercussions, including hefty fines, loss of licenses, and even imprisonment. If the allegations against Anderson and Anson Funds are proven true, it could tarnish the reputation of Hindenburg Research and affect its future operations and credibility. Investors and analysts will likely be closely monitoring the situation to assess the potential fallout.

What Is Securities Fraud?

Securities fraud encompasses a range of illegal activities that deceive investors or manipulate financial markets. This can include insider trading, misrepresentation of information, and failure to disclose pertinent financial information. Given the gravity of these accusations, the investigation will likely delve deep into the practices of Hindenburg Research and its affiliates, scrutinizing both past and present operations.

Potential Consequences for Investors

For investors who have relied on Hindenburg Research’s reports for their financial decisions, this news could lead to a reassessment of their strategies. Trust in research firms is paramount, and any indication of wrongdoing can create volatility in the markets. Investors may become wary of relying solely on external analyses, opting instead for more diversified information sources.

The Future of Hindenburg Research

As the investigation unfolds, the future of Hindenburg Research remains uncertain. The firm’s ability to operate effectively may be compromised if serious allegations are substantiated. Additionally, competitors may take advantage of this situation to position themselves as more reliable alternatives. This scenario underscores the importance of transparency and ethical conduct within the financial sector.

Conclusion

In conclusion, the investigation into Nathan Anderson and Hindenburg Research for securities fraud marks a critical moment in financial history. As more information becomes available, stakeholders across the financial landscape will be watching closely. Investors, regulators, and analysts must stay informed about the developments surrounding this case, as its outcomes could reshape perceptions of integrity and accountability in finance. The situation serves as a reminder that even those who position themselves as guardians of financial ethics are not immune to scrutiny.

Hindenburg Research, Founder Nathan Anderson named in ‘Investigations for Securities Fraud & Faulty Disclosures’ as per reports.

“There are multiple counts of securities fraud for both Nate Anderson and Anson Funds, and we have only reviewed 5% of the material… pic.twitter.com/iE0CGZJdRJ

— Megh Updates (@MeghUpdates) January 19, 2025

BREAKING: Hindenburg Research Under Investigation

In a startling development, Hindenburg Research and its founder, Nathan Anderson, are reportedly facing serious investigations regarding securities fraud and faulty disclosures. As per reports, there are multiple counts of securities fraud against both Nate Anderson and Anson Funds. It’s a situation that has many in the finance and investment world on high alert. The investigation, which has only reviewed a mere 5% of the material so far, raises questions about the integrity of financial disclosures and practices in the industry.

Nathan Anderson: A Controversial Figure

Nathan Anderson, the founder of Hindenburg Research, has been a polarizing figure in the financial sector. Hindenburg is known for its aggressive short-selling tactics, targeting companies it believes are overvalued or involved in fraudulent activities. Anderson’s research reports have led to significant market movements, often resulting in financial losses for the companies targeted. This latest investigation adds another layer of complexity to his already controversial reputation.

Many investors and analysts are now questioning the reliability of Hindenburg’s previous reports. With allegations of securities fraud looming over Anderson and his firm, how will this impact the trust that stakeholders place in his future analyses?

The Nature of the Allegations

The allegations against Hindenburg Research and Nathan Anderson are serious. Securities fraud encompasses a range of illegal activities that deceive investors or manipulate financial markets. This can include insider trading, misrepresentation of information, and issues surrounding the transparency of financial disclosures.

The reports suggest that the investigations could reveal troubling practices within Hindenburg Research, potentially exposing a pattern of deceit that could have significant ramifications for both Anderson and the broader finance community. The limited review of just 5% of the material indicates that there may be a substantial amount of evidence yet to be uncovered, leaving many to speculate on what could be revealed as the investigation unfolds.

The Impact on Investors and the Market

As news of the investigation spreads, the impact on investors and the market is palpable. Investors who have previously relied on Hindenburg’s analyses may be reconsidering their strategies, especially those who have followed Anderson’s recommendations without question.

Market reactions to such investigations can be swift and volatile. Stocks of companies that have been targeted by Hindenburg in the past might experience increased scrutiny and fluctuating prices as traders and investors weigh the allegations against the firm. Those who have shorted stocks based on Hindenburg’s reports may find themselves in precarious positions as the investigation progresses.

What’s Next for Hindenburg Research?

The future of Hindenburg Research and Nathan Anderson hangs in the balance as investigations continue. If the allegations are substantiated, the implications could be severe, potentially leading to legal repercussions that might include substantial fines or even criminal charges. Moreover, the firm’s reputation could suffer irreparable damage, resulting in a loss of credibility that would be hard to recover from.

For now, all eyes are on the developments of this case. Stakeholders are eager to learn more about the claims and how they will affect the financial landscape. Will Hindenburg Research be able to defend its practices, or will the findings lead to a broader conversation about ethics in financial reporting?

Understanding Securities Fraud

Securities fraud is a term that encompasses various illegal activities in the financial markets, aimed at misleading investors or manipulating stock prices. It’s crucial for investors to understand what securities fraud entails, as it can have devastating consequences not just for the individuals involved, but for the market as a whole.

Common forms of securities fraud include:

– **Insider Trading**: When individuals trade stocks based on non-public information, thereby gaining an unfair advantage.

– **Ponzi Schemes**: Fraudulent investment operations where returns are paid to earlier investors using the capital from newer investors.

– **False Statements**: Misrepresentation of a company’s financial health or operations to lure investors.

Recognizing these red flags can help investors protect themselves from falling victim to fraud and ensure they make informed decisions.

Public Reaction and Media Coverage

The public’s reaction to this news has been mixed, with many expressing outrage over the possibility of fraud in a sector that’s meant to uphold integrity and transparency. The media has also been quick to cover the story, with outlets like [Business Insider](https://www.businessinsider.com) and [MarketWatch](https://www.marketwatch.com) providing in-depth analyses and updates on the unfolding situation.

Social media has played a significant role in spreading information, with hashtags like #BREAKING trending as more people become aware of the investigation. This level of public scrutiny could further amplify the pressure on Nathan Anderson and Hindenburg Research as the investigation progresses.

The Importance of Transparency in Financial Markets

This incident underscores the critical need for transparency and accountability in financial markets. Investors deserve to receive accurate information to make informed decisions, and any breach of trust can have far-reaching consequences.

The investigation into Hindenburg Research may serve as a catalyst for discussions about the need for stricter regulations and enhanced oversight in the financial sector. As we continue to navigate these turbulent waters, the focus will remain on ensuring that integrity is upheld in all financial dealings.

As the investigation unfolds, it’s essential for both investors and the broader public to stay informed about developments. Trust in financial markets is paramount, and any breach could lead to significant shifts in how these markets operate moving forward.