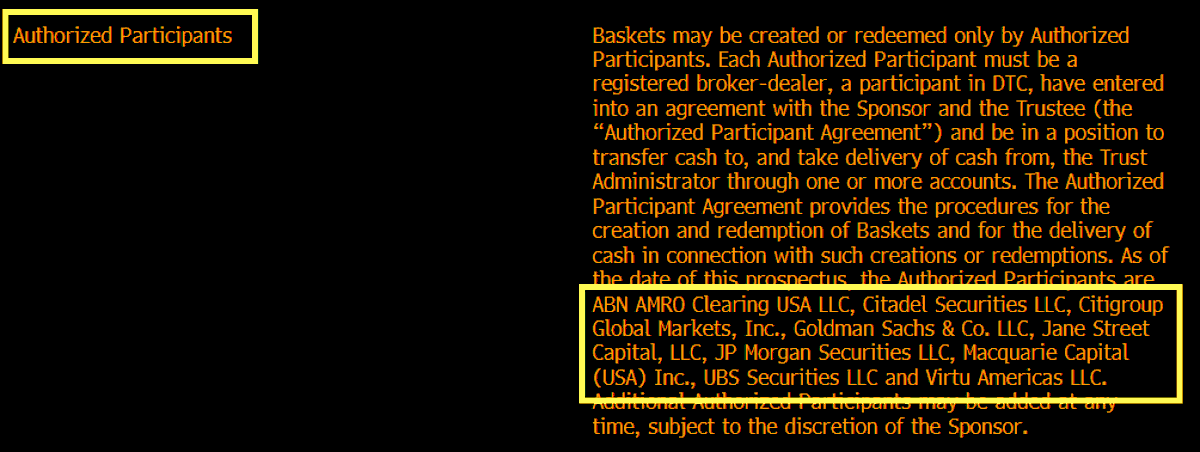

In a recent development that has sent shockwaves through the financial world, BlackRock, the world’s largest asset manager, has updated its bitcoin ETF prospectus with many new Authorized Participants, including first-timers Citadel, Goldman Sachs, UBS, and Citigroup. This move signifies a major shift in the attitude of big-time financial firms towards cryptocurrency, as they now seem eager to get a piece of the action or at least are comfortable being publicly associated with it.

The inclusion of these prestigious firms as Authorized Participants in BlackRock’s bitcoin ETF marks a significant milestone in the mainstream adoption of cryptocurrency. It shows that even the most traditional and conservative financial institutions are starting to recognize the potential of digital assets as a legitimate investment class.

You may also like to watch : Who Is Kamala Harris? Biography - Parents - Husband - Sister - Career - Indian - Jamaican Heritage

The decision by BlackRock to update its bitcoin ETF prospectus comes at a time when the cryptocurrency market is experiencing unprecedented growth and interest from institutional investors. With the price of bitcoin reaching new all-time highs and the overall market cap of all cryptocurrencies exceeding trillions of dollars, it is clear that digital assets have become too big to ignore.

The involvement of firms like Citadel, Goldman Sachs, UBS, and Citigroup as Authorized Participants in BlackRock’s bitcoin ETF is a clear indication that these institutions see the potential for significant returns in the cryptocurrency market. By becoming Authorized Participants, these firms will be able to buy and sell bitcoin on behalf of their clients, providing them with exposure to the fast-growing digital asset.

This move by BlackRock also highlights the increasing acceptance of bitcoin and other cryptocurrencies by mainstream financial institutions. In the past, many traditional banks and asset managers were hesitant to get involved in the cryptocurrency market due to its perceived risks and regulatory uncertainties. However, as the market has matured and regulatory clarity has improved, more institutions are starting to dip their toes into the world of digital assets.

The inclusion of these big-name firms as Authorized Participants in BlackRock’s bitcoin ETF is likely to attract even more institutional investors to the cryptocurrency market. With the backing of such prestigious institutions, the legitimacy of bitcoin as an investment asset is further reinforced, making it more attractive to conservative investors who may have previously been hesitant to enter the market.

You may also like to watch: Is US-NATO Prepared For A Potential Nuclear War With Russia - China And North Korea?

In addition to Citadel, Goldman Sachs, UBS, and Citigroup, several other major financial institutions have also shown interest in the cryptocurrency market in recent months. JPMorgan Chase, for example, has launched its own digital asset division, while Morgan Stanley has started offering bitcoin funds to its wealthy clients. These developments are further evidence of the growing acceptance of cryptocurrency in the mainstream financial world.

Overall, the involvement of firms like Citadel, Goldman Sachs, UBS, and Citigroup as Authorized Participants in BlackRock’s bitcoin ETF is a game-changer for the cryptocurrency market. It signals a new era of acceptance and adoption by mainstream financial institutions, paving the way for even greater growth and investment in the digital asset space.

In conclusion, the inclusion of these prestigious firms as Authorized Participants in BlackRock’s bitcoin ETF is a clear sign that the cryptocurrency market is entering a new phase of mainstream acceptance. With the backing of such major institutions, the legitimacy of bitcoin as an investment asset is further solidified, attracting more institutional investors and paving the way for continued growth and innovation in the digital asset space..

JUST IN: BlackRock updated its bitcoin ETF prospectus w/ many new Authorized Participants incl first-timers Citadel, Goldman Sachs, UBS, Citigroup. Takeaway: big time firms now want piece of action and/or are now OK being publicly associated w this. H/t @akibablade @CryptoSlate… pic.twitter.com/z5Ntb43VhO

— Eric Balchunas (@EricBalchunas) April 5, 2024

Source

EricBalchunas said JUST IN: BlackRock updated its bitcoin ETF prospectus w/ many new Authorized Participants incl first-timers Citadel, Goldman Sachs, UBS, Citigroup. Takeaway: big time firms now want piece of action and/or are now OK being publicly associated w this. H/t @akibablade @CryptoSlate…

RELATED STORY.