“Tesla announces reduced EV tax credit of $3,750 for both RWD and Long Range Model 3s starting Jan 1, 2024”

You may also like to watch : Who Is Kamala Harris? Biography - Parents - Husband - Sister - Career - Indian - Jamaican Heritage

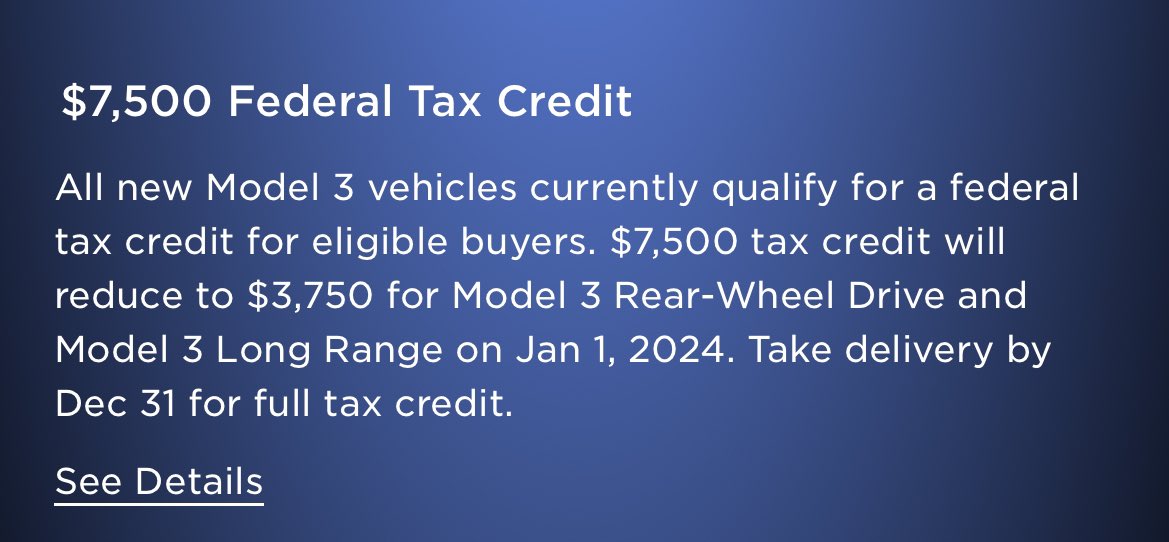

BREAKING: Tesla now says on the U.S. Model 3 order page that the $7,500 EV tax credit is expected to reduce to $3,750 for BOTH the RWD and Long Range Model 3 on Jan 1, 2024. Previously it was only the RWD.

They encourage ppl to take delivery in Q4 to guarantee full incentive. pic.twitter.com/HZ9gLlQjqT

— Sawyer Merritt (@SawyerMerritt) December 1, 2023

https://platform.twitter.com/widgets.js

You may also like to watch: Is US-NATO Prepared For A Potential Nuclear War With Russia - China And North Korea?

BREAKING: Tesla Announces Reduction in EV Tax Credit for Model 3

In a recent update on Tesla’s U.S. Model 3 order page, the electric vehicle manufacturer revealed that the federal electric vehicle (EV) tax credit will be reduced from $7,500 to $3,750 for both the Rear-Wheel Drive (RWD) and Long Range versions of the Model 3 starting on January 1, 2024. This update comes as a surprise to many potential buyers who were expecting the reduction to only apply to the RWD model.

This new announcement has caused a frenzy among Tesla enthusiasts, with many speculating on the reasons behind the decision. Some argue that the reduction in the tax credit could be due to the company’s belief that electric vehicle adoption is reaching a point where such incentives are no longer necessary. Others believe that it may be a strategic move to encourage customers to take delivery of their vehicles in the fourth quarter of 2023 to ensure they receive the full incentive.

The federal EV tax credit was introduced to incentivize the adoption of electric vehicles and reduce carbon emissions. It allows eligible buyers to claim a tax credit of up to $7,500, depending on the vehicle’s battery capacity. However, the credit phases out once an automaker sells 200,000 electric vehicles in the United States, as Tesla reached this milestone in 2018.

As the tax credit reduction draws near, potential buyers are now faced with a decision. Many are considering accelerating their purchase plans to take advantage of the higher tax credit available in the fourth quarter of 2023. This rush to secure the full incentive could lead to increased sales for Tesla in the coming months.

The reduction in the tax credit may also impact the overall affordability of the Model 3 for some potential buyers. With a starting price of $39,990 for the RWD and $49,990 for the Long Range version, the tax credit reduction could make the vehicle less attractive to budget-conscious consumers.

As the EV market continues to grow, the reduction in the federal tax credit for Tesla’s Model 3 marks a significant shift in the incentives available to buyers. It remains to be seen how this change will impact the demand for the Model 3 and the broader electric vehicle market.

Tesla has always been at the forefront of the electric vehicle revolution, and this latest announcement is another example of the company’s ability to adapt and respond to changing market conditions. As the January 1, 2024 deadline approaches, it will be interesting to see how Tesla and its customers navigate the evolving landscape of EV incentives and regulations..

Source

@SawyerMerritt said BREAKING: Tesla now says on the U.S. Model 3 order page that the $7,500 EV tax credit is expected to reduce to $3,750 for BOTH the RWD and Long Range Model 3 on Jan 1, 2024. Previously it was only the RWD. They encourage ppl to take delivery in Q4 to guarantee full incentive.

RELATED STORY.